Focus

Sectors

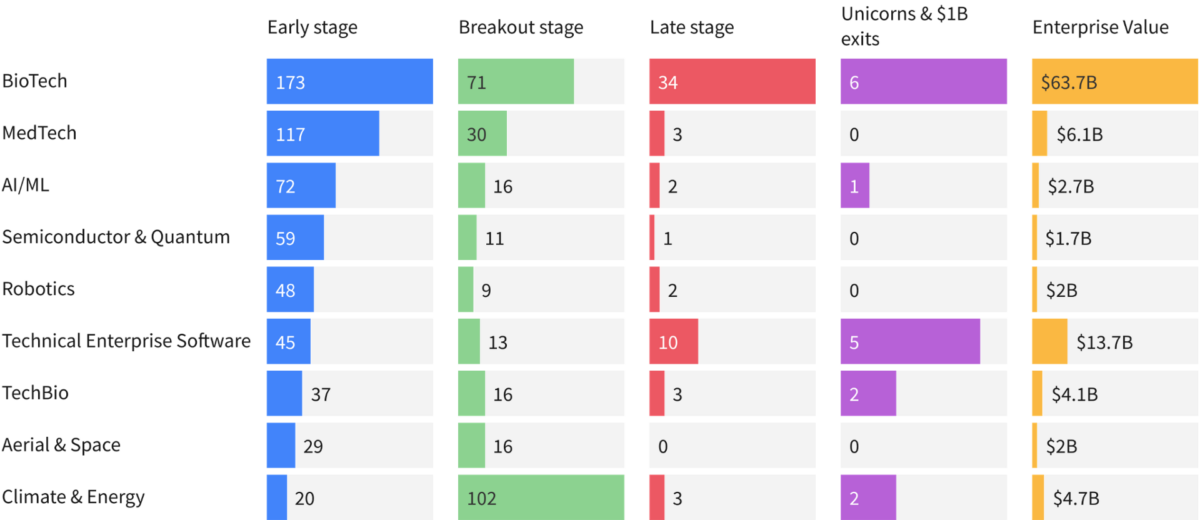

Switzerland’s Excellence Across Deep Tech Verticals

Switzerland has established itself as a global deep tech leader across diverse verticals. From traditional strengths in biotech and micro-engineering to emerging fields like quantum computing and AI, Swiss innovation solves global challenges at scale. Explore the deep tech sectors driving this excellence and the startups defining their future.

Swiss Deep Tech Verticals

A Broad Range of Excellence

Historically renowned for biotech and micro-engineering, Switzerland’s deep tech landscape has evolved into a diverse ecosystem spanning multiple cutting-edge verticals. While biotech continues to represent the largest share of Swiss startups, the pipeline across quantum technologies, advanced robotics, climate tech, and AI is expanding rapidly. This diversification reflects key structural advantages: world-leading universities like ETH Zurich and EPFL, exceptional technical talent, innovative corporations and Mittelstand companies, business-friendly regulations, and political stability. These factors have cultivated a startup ecosystem now recognized globally as one of the most dynamic, with strength across the full spectrum of deep tech verticals.

A Rapidly Evolving Focus

Switzerland’s deep tech ecosystem demonstrates remarkable agility in responding to emerging technological opportunities. Thanks to its bottom-up approach to innovation and heavy academic involvement in commercialization, Swiss startups rapidly develop expertise in new verticals. Recent years have seen accelerated growth in climate technologies, quantum computing, advanced AI, and next-generation materials. Swiss universities identify promising breakthroughs early, while experienced investors and corporate partners channel resources toward the most impactful opportunities, ensuring Switzerland remains at the forefront of technological innovation.

«Switzerland has become a Deep Tech powerhouse on the global stage, so it is only natural that we spend time there identifying the next big opportunities. Swiss success stories like ANYbotics, Scandit, and Climeworks are due to the convergence of several factors ranging from Swiss academic excellence, a strong IP culture, and close collaboration with Swiss industrial leaders that benefits local Deep Tech startups.»

Nicolas Autret

Partner

Walden Catalyst Ventures

«Within Europe, Switzerland is one of the hottest places for Deep Tech in 2025 and onwards. In our flagship European Deep Tech report we highlight how Deep Tech has taken the startup and venture capital world by storm the last few years, and now accounts for nearly one-third of Europeʼs VC funding, up 2.5x in the last decade.»

Yoram Wijngaarde

Founder and CEO

Dealroom.co

Discover Swiss startups

In the Swiss Deep Tech Report 2025, we identify leading startups and rising stars in each Deep Tech vertical, including AI, Technical Enterprise Software, Robotics, Aerial & Space, Semiconductors & Quantum, Climate Tech & Energy, TechBio, BioTech, and MedTech.

Focus Sector Deep Dives

In Deep Tech Nation Switzerland, Dominique Mégret provides an in-depth look at each Deep Tech vertical and outlines Switzerland’s strengths and weaknesses therein.