/

From Momentum to Mission: What the Latest VC-Trends Mean for Deep Tech in Switzerland

This mid-year reading of startupticker.ch and SECA’s Swiss VC Report takes the surface rebound—a healthy rise in invested capital—and weighs it against quieter signals: fewer deals overall, a funding tide still pulled toward biotech, regional and sectoral imbalances that leave Robotics, AI, Climate Tech and many cantons short of fuel, and a capital stack still leaning on foreign backers.

A mixed picture with a message

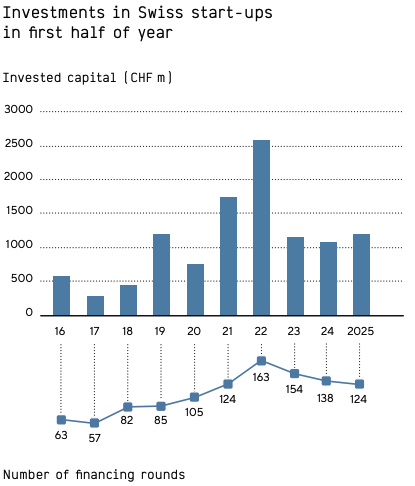

The Swiss startup ecosystem recorded a notable uptick in the first half of 2025: venture capital investment surged 36% year-over-year, reaching CHF 1.47 billion – the third-highest half-year figure on record. This growth, largely driven by standout biotech deals and a recovery in fintech and ICT, might suggest a full rebound is underway.

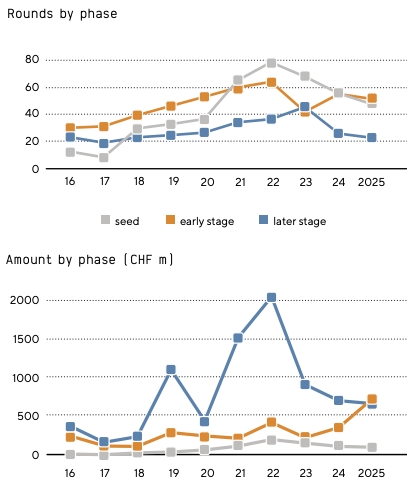

But the story is more complex. The number of financing rounds fell again – down 10.1% – continuing a three-year trend. Startups across all phases are still struggling to access capital. While record-breaking rounds from biotech players like Windward Bio and GlycoEra drew headlines, many promising ventures are not getting the fuel they need to grow.

As the foundation tasked with making Switzerland the world’s leading Deep Tech nation, we see these signals not as discouragements, but as direction markers. Our role is to ensure that the benefits of growth are broad, sustainable, and resilient.

A Deep Tech Nation – but with uneven depth

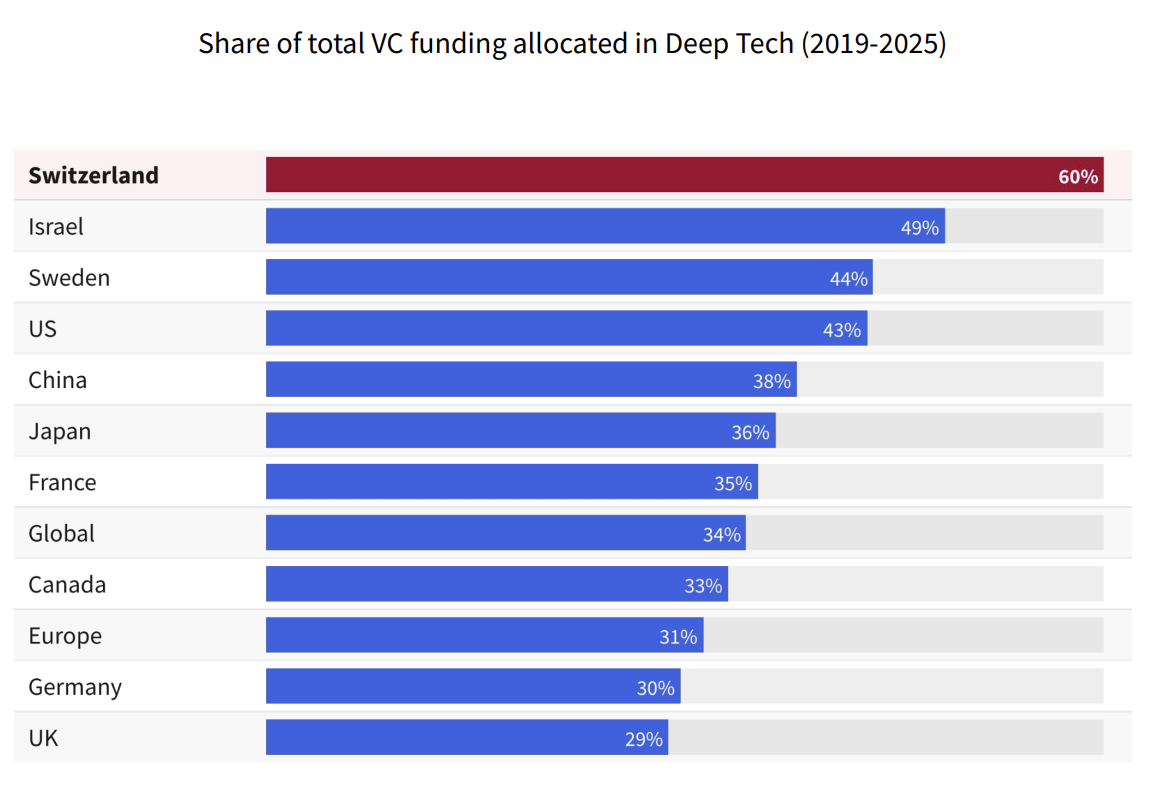

Switzerland leads the world in Deep Tech capital intensity. According to the recently published Swiss Deep Tech Report 2025, 60% of all VC in the country now flows into Deep Tech ventures, a global record. We rank first in Europe in per capita Deep Tech funding, and our universities, such as ETH Zurich, EPFL and others, are top-tier launchpads for spinouts. Swiss universities ranked very high in Europe for spin-out value creation in the report.

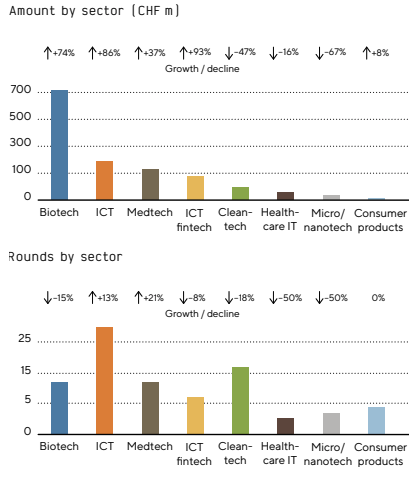

Yet the funding landscape is top-heavy. While biotech set a record with CHF 705 million invested, the number of biotech rounds declined – reflecting increased concentration rather than broader vitality. Other key Deep Tech areas like Robotics, AI/ML, and Climate Tech remain underfunded relative to their potential and strategic importance.

The same concentration applies geographically: while Zurich, Basel-Stadt, and Vaud continue to lead in capital and deal activity, it’s essential to ensure that promising ventures across Switzerland have access to the same networks, funding opportunities, and visibility. A strong ecosystem benefits from both high-performing hubs and broader national connectivity.

International trust, domestic gaps

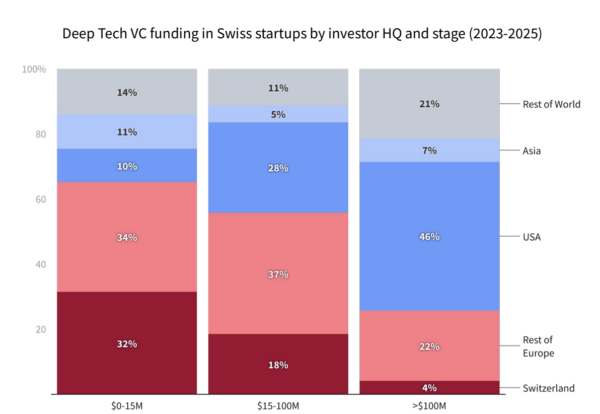

International investors continue to dominate Swiss Deep Tech. In H1 2025, over 85% of Deep Tech venture capital came from abroad, with US-based funds alone contributing more than CHF 520 million – over a third of the total amount. This is a strong signal of external confidence in our science and talent.

But the domestic gap is worrying. Swiss capital makes up just a third of early-stage investments in deep tech – and only 4% of late-stage rounds. This leaves many scale-up-stage companies reliant on foreign direction, which can dilute long-term value creation for our economy.

To fulfil our national ambition, we need deeper local engagement. That includes activating institutional investors, creating more late-stage capital, and fostering corporate venture collaboration.

Exits and the scale-up cliff

The first half of 2025 produced a handful of bright exit moments: Araris Biotech found a unicorn-level buyer in Taiho Pharmaceutical, BioVersys tapped SIX to raise CHF 80 million, and ICT exits ticked up from six to ten deals. These wins prove that Swiss know-how can clear that final hurdle.

Yet the overall exits remain low. Strategic buyers are cautious, IPO windows open only a crack, and most of the new ICT exits involve very young targets, not the scale-ups that drive jobs and GDP.

That same squeeze shows up one rung earlier in the funding ladder. Seed and early-stage rounds reached record highs, powered by bold biotech bets, but late-stage capital slipped again to CHF 660 million, already 65 percent below the 2022 peak. The number of growth rounds is now lower than it was in 2019.

Building the future we deserve

Switzerland is home to extraordinary innovation capacity. We lead the Global Innovation Index for the 14th consecutive year. Our AI and Robotics talent density is leading in Europe. And our Deep Tech startup pipeline is expanding rapidly beyond Biotech, into AI, TechBio, and Climate Tech.

But building a true Deep Tech Nation requires more than international accolades and breakthrough headlines. It requires local conviction. It requires us to not only attract capital but grow it here. To not just launch companies but help them scale globally from Swiss soil. The trends of 2025 show both promise and pressure.

At Deep Tech Nation Switzerland, we are working to turn that pressure into progress by building bridges across sectors, funding gaps, and geographies.

Switzerland has what it takes to lead the next wave of technology. Let’s make sure we match that potential with the resolve to act.

Read the full article on H1 2025 VC development on startupticker.ch

More Content

-

More money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

Impatience is Imperative There is a distinct cultural friction when a Swiss founder steps into the US market. In Switzerland, the prevailing operating system is…

-

The Art of the Imperfect Bet A venture capitalist is only as good as their conviction when things look messy. For Alessandra Agnello, the “perfect deal”…