/

Swiss Deep Tech Venture Capital: The 2025 European Deep Tech Report Analysis

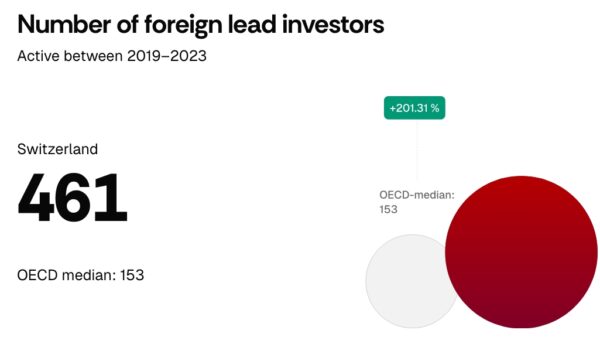

Europe’s deep tech ecosystem has become a potent driver of innovation, standing strong despite broader venture capital market fluctuations. Switzerland is gaining recognition as a leading hub for deep tech venture capital, combining research excellence with strong commercialization strategies. The 2025 European Deep Tech Report highlights Switzerland’s growing role in this dynamic sector.

Switzerland’s deep tech strength is not just an academic or entrepreneurial success; it has become a significant economic pillar. Deep tech startups are increasingly viewed as crucial for Europe’s industrial competitiveness, national security, and environmental objectives. As scientific breakthroughs transition into scalable businesses, Switzerland is uniquely positioned to lead the sector’s growth.

With established research institutions, strong corporate partnerships, and a growing pool of specialized investors, Switzerland has become a beacon for deep tech innovation. The country’s ability to develop science-driven solutions that address fundamental global challenges makes it an attractive destination for venture capital firms. By leveraging its strengths in engineering, biotech, and AI, Switzerland has cultivated a robust startup scene, supported by a vibrant innovation ecosystem.

Deep Tech as Europe’s Innovation Backbone

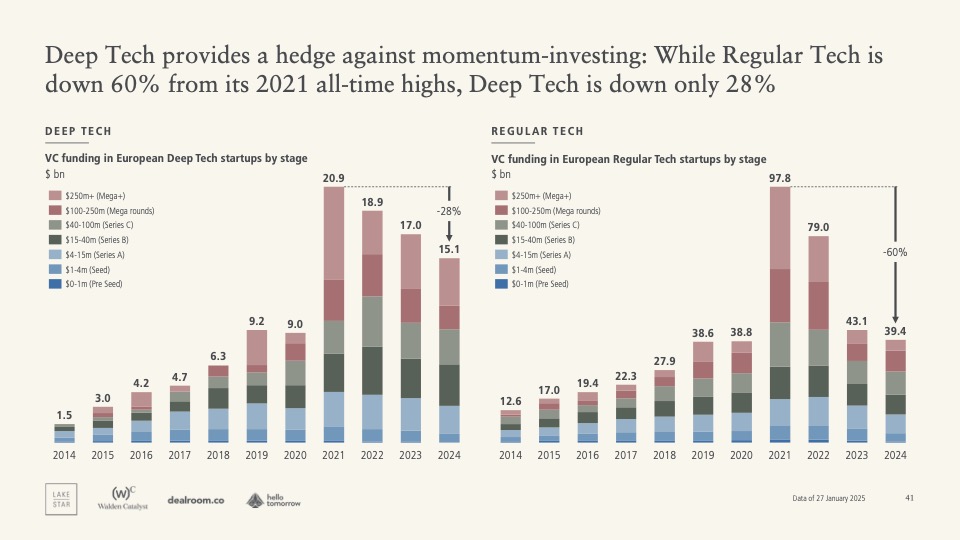

Despite a sharp decline in overall VC investment since 2021, deep tech venture capital has demonstrated resilience. While general tech funding fell by 60% from its 2021 peak, deep tech saw only a 28% drop. This stability reflects investor confidence in biotech, cleantech, and novel AI among others, where Switzerland excels.

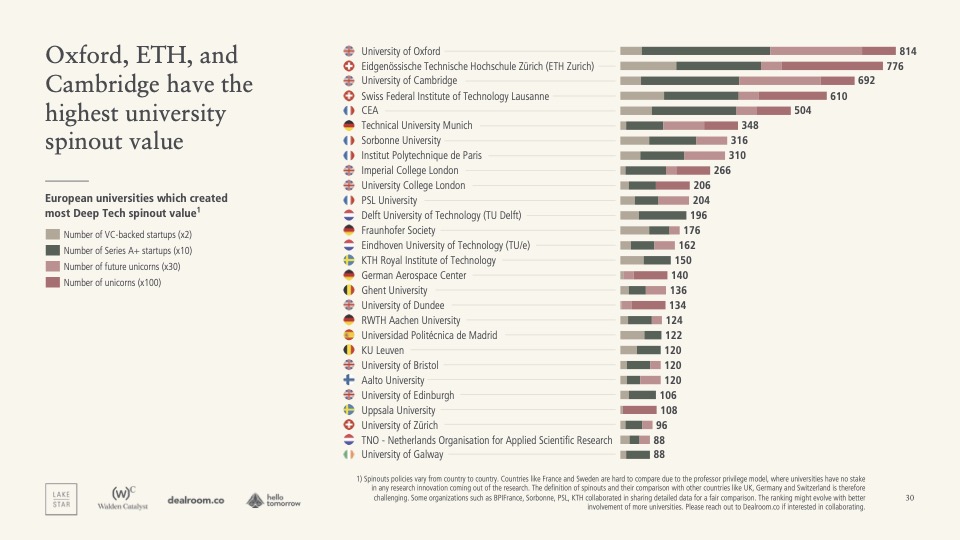

Switzerland’s deep tech ecosystem is anchored by its world-renowned institutions, such as ETH Zurich and EPFL, which produce groundbreaking research. Swiss strengths in precision engineering and hardware innovation are especially valuable in robotics, photonics, and computational biology. Companies like ANYbotics, 9T Labs, and Cutiss illustrate Switzerland’s ability to convert academic advancements into thriving startups.

This resilience is no coincidence: deep tech solutions often address fundamental challenges in energy, healthcare, and industrial processes. While consumer-focused tech frequently struggles with shifting trends, deep tech benefits from stable, long-term investment horizons. Swiss firms’ ability to commercialize research-driven innovations ensures continued investor confidence.

In addition, Switzerland’s emphasis on precision engineering ensures startups are well-equipped to develop solutions that demand technical rigor. Robotics, medical devices, and industrial automation continue to thrive as Swiss startups build on deep scientific foundations. Investors are drawn to these sectors not only for their growth potential but also for their ability to address real-world needs.

The Evolving Deep Tech Funding Landscape

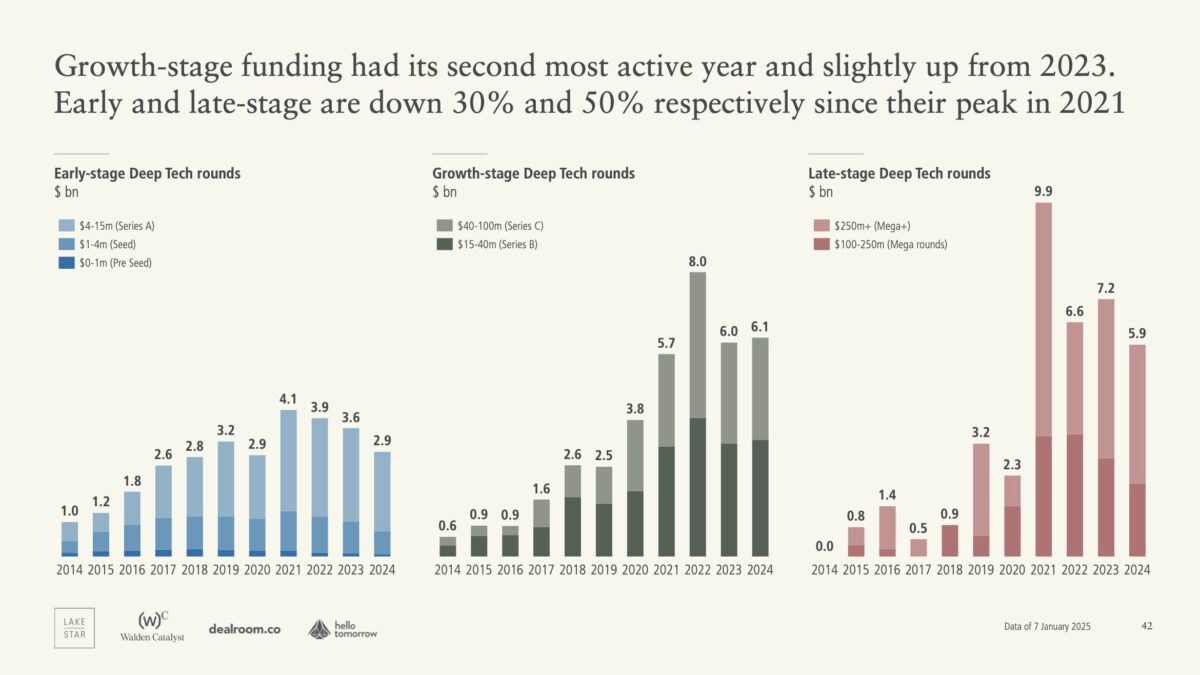

The European deep tech funding landscape has shifted toward fewer but larger funding rounds. Growth-stage deep tech funding remained stable in 2024, while early-stage and late-stage funding dropped by 30% and 50%, respectively. This trend reflects consolidation, with investors prioritizing proven startups that have clear commercial potential.

For Switzerland, this shift aligns with a growing focus on quality over quantity. Investors are increasingly directing capital toward startups that demonstrate market readiness and scalable solutions. While this strategy ensures high-impact ventures receive sufficient funding, it presents challenges for emerging startups still navigating the development phase.

To counter this risk, Swiss initiatives like Innosuisse and the Swiss Technology Fund are providing essential support to startups in key technology sectors. These initiatives play a vital role in maintaining Switzerland’s sovereignty over critical innovations, especially as US and Chinese investors increasingly target Swiss startups for acquisition.

Swiss investors are adopting a proactive stance by emphasizing growth-stage funding for startups with strong commercialization strategies through initiatives like Deep Tech Nation Switzerland Foundation. This shift is vital for ensuring Swiss innovations remain under domestic control, safeguarding the nation’s technological future.

Furthermore, Switzerland’s strategic proximity to major European markets positions its startups to secure international funding. Investors seeking high-impact, scalable ventures are increasingly drawn to Swiss startups that combine scientific breakthroughs with proven market strategies.

Switzerland’s Strategic Deep Tech Advantage

Switzerland’s dominance in deep tech venture capital is particularly strong in key sectors:

Robotics

ANYbotics ($60M funding) is scaling rapidly, particularly in inspection, logistics, and autonomous navigation. Swiss strengths in precision engineering continue to drive robotic innovation. With increasing demand for automation solutions and a focus on customer success, Swiss robotics startups are poised to become vital global players.

Life Sciences

With leaders like SOPHiA GENETICS and CRISPR Therapeutics, Swiss biotech startups are attracting international capital and advancing personalized medicine solutions. The country’s biotech industry has benefited from strong partnerships with global pharmaceutical firms, accelerating commercialization timelines.

Climate Tech

Swiss firms are playing a major role in advancing solar-based fuel production, hydrogen solutions, and carbon capture. Startups like Climeworks or Synhelion have secured major investments in cleantech innovation. With growing global demand for decarbonization solutions, Switzerland’s energy innovation ecosystem continues to expand.

Vaud and Geneva saw overall investment growth in 2024, while Zurich continues to thrive in biotech and AI. Basel’s pharmaceutical sector has also become a catalyst for biotech spinoffs that combine corporate expertise with startup agility. This diversified landscape ensures Switzerland’s deep tech sector remains resilient and globally competitive.

Switzerland’s strength in manufacturing and engineering further enhances its deep tech ecosystem. Companies developing specialized hardware for quantum computing, photonics, and next-generation materials benefit from Switzerland’s infrastructure and talent pool.

Closing the Commercialization Gap

While Europe leads in scientific discoveries, it has traditionally struggled to turn those breakthroughs into scalable businesses. Switzerland is making significant progress in closing this commercialization gap.

Initiatives like Wyss Zurich and EPFL’s Innovation Park are essential for bridging this divide. These hubs provide critical mentorship, funding, and corporate connections that help startups scale. Additionally, Switzerland’s dense network of industry leaders across pharmaceuticals, finance, and manufacturing creates a valuable market for emerging ventures.

Swiss corporate-backed venture capital programs, such as Roche Venture Fund and Swisscom Ventures, are further addressing this gap. By investing in startups aligned with their strategic interests, these corporate investors provide startups with both funding and industry-specific expertise.

This combination of mentorship, capital, and market access has helped Swiss startups overcome traditional barriers to commercialization. As a result, Switzerland is gaining international recognition for its ability to turn deep tech innovations into thriving businesses.

In addition to corporate partnerships, Swiss universities are expanding their focus on entrepreneurship programs. These initiatives encourage students and researchers to pursue startup opportunities, ensuring a continuous pipeline of talent and ideas. This cultural shift toward entrepreneurial thinking has helped Switzerland strengthen its commercialization capabilities.

Switzerland’s Opportunity to Lead

Switzerland’s deep tech ecosystem is well-positioned for growth, driven by several key factors. The country’s strong foundation in research excellence is steadily translating into scalable businesses, ensuring that scientific breakthroughs are effectively commercialized. Additionally, the consolidation of growth-stage funding has played a significant role in enabling high-potential startups to secure the capital they need to expand successfully.

Sustainability-driven innovation is also attracting record investment, reinforcing Switzerland’s leadership in cleantech and environmentally conscious technologies. Meanwhile, AI-enhanced scientific discovery is accelerating progress across sectors (such as AI-enabled driving,) unlocking new opportunities for investors and startups alike. Emerging moonshot technologies are further strengthening Switzerland’s global standing, positioning the country at the forefront of future technological breakthroughs.

More DTN News

-

Today marks a defining moment for the Swiss innovation ecosystem. Deep Tech Nation Switzerland officially launching Project Switzerland, a national initiative with a singular, critical…

-

More money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

Impatience is Imperative There is a distinct cultural friction when a Swiss founder steps into the US market. In Switzerland, the prevailing operating system is…