European Spinouts Report 2025: Switzerland Confirmed as Europe’s Deep Tech Powerhouse

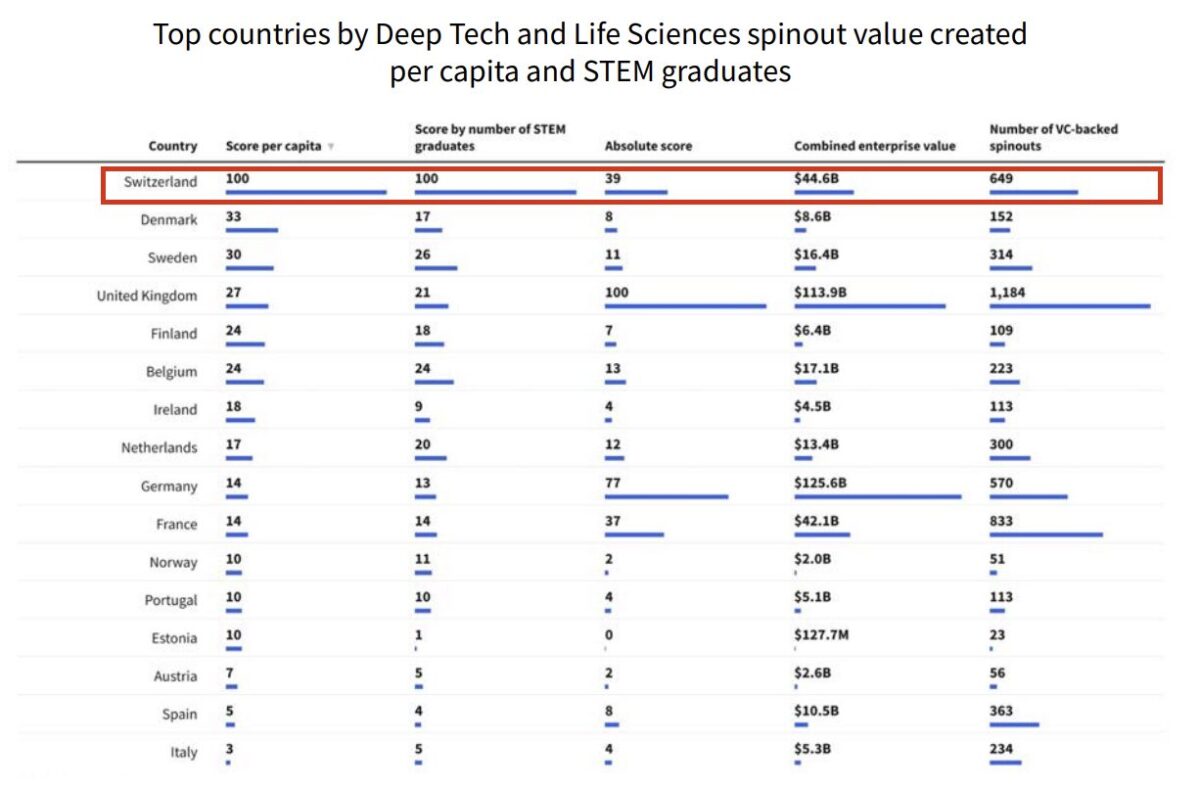

The most critical metric in innovation is not volume but efficiency. While larger economies naturally produce higher absolute numbers of companies, the true measure of an ecosystem’s vitality is its ability to convert research and talent into tangible economic value. The newly released “European Spinouts Report 2025” offers a definitive validation of the Swiss strategy. It confirms that Switzerland creates more spinout value per capita and per STEM graduate than any other nation in Europe.

The European Spinout Report 2025 analyses European value creation and trends in spinouts, highlighting the region’s leading academic institutions, countries, sectors, and founders. Launched by Atlantic.vc, Cambridge Innovation Capital, Dealroom.co, MITO Technology, Northern Gritstone, and Oxford Science Enterprises, it is the first comprehensive analysis of the academic spinout sector across Europe.

This efficiency is not accidental. It is the result of a structural commitment to deep technology that pervades the Swiss academic and economic landscape. As Europe faces a competitiveness crisis, Switzerland provides a blueprint for how to build a resilient and high-value economy rooted in scientific discovery.

Swiss Spinouts at a Glance

For those looking for the immediate takeaways, the data highlights a distinct Swiss advantage in quality and specialization:

Unmatched Efficiency:

Switzerland generates the highest spinout value relative to population and STEM graduates in Europe, scoring 100 on the per capita index versus the runner-up’s 33

Institutional Dominance:

ETH Zurich (#3) and EPFL (#4) are firmly established in the top 5 European universities for spinout value creation

Sector Dominance:

ETH Zurich ranks as the #1 university in Europe for spinout value creation in both Robotics and Climate Tech

The Density of Excellence

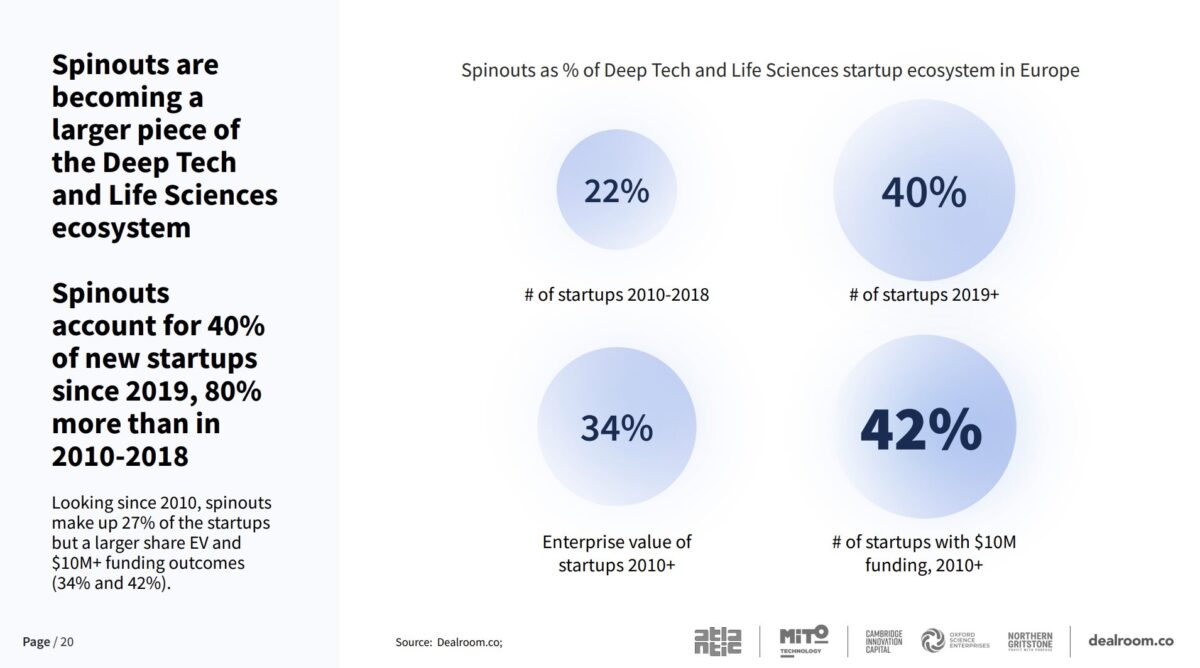

The European landscape is shifting. Deep tech and life sciences spinouts are becoming the primary drivers of new value creation across the continent. Since 2019, spinouts have accounted for 40 percent of all new startups in these sectors, an 80 percent increase compared to the previous decade.

Within this shifting landscape, Switzerland’s performance is disproportionately strong. The country ranks third in Europe for absolute combined enterprise value created by spinouts at $44.6 billion, trailing only the much larger economies of the UK and Germany. However, when adjusted for population size and the number of STEM graduates, Switzerland moves to the undisputed first position.

This per-capita dominance suggests a superior conversion rate of academic research into commercially viable equity. It implies that the transfer mechanisms at Swiss institutions are functioning with higher efficacy than their continental peers. Recent data from startupticker.ch’s mid-year Swiss VC Report supports this trajectory, reporting that Swiss startups generated CHF 1.47 billion in venture capital in the first half of 2025 alone, a 36% increase compared to the previous year.

Institutional Heavyweights: ETH Zurich and EPFL

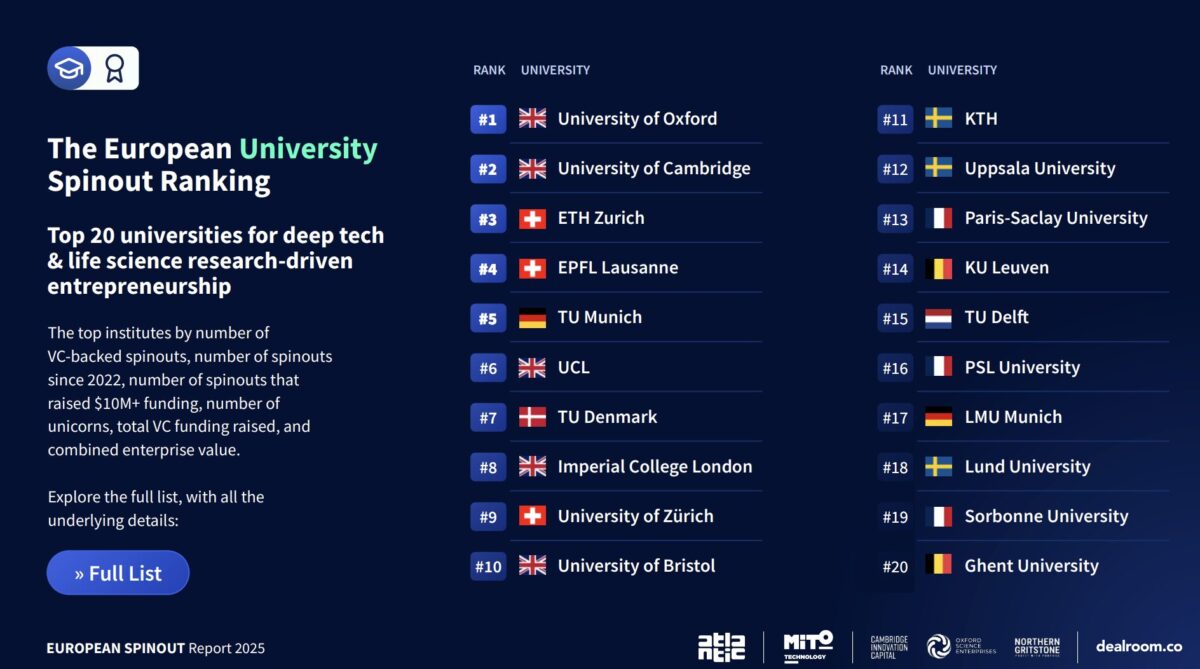

The report highlights the central role of Switzerland’s two federal institutes of technology. In the ranking of top universities for deep tech and life sciences spinout value creation, ETH Zurich ranks third and EPFL ranks fourth in Europe. They sit immediately behind Oxford and Cambridge, placing them at the very apex of continental European innovation.

The University of Zurich also performs strongly, securing the ninth spot in the top 10 European universities. This concentration of three top-tier institutions within a single small nation creates a cluster effect that is difficult to replicate.

“Switzerland stands at the forefront of global AI innovation, leading with the highest AI patents per capita and one of the most dynamic startup ecosystems. At EPFL, we believe that great science is the seed of great startups. Supporting researchers as they challenge the purpose of their technology, and helping them grow into entrepreneurs, is part of our DNA.”

Andrea Crottini – Head of Technology Transfer Office, EPFL

Sector Specifics: Beyond the Generalists

The success of the Swiss spinout ecosystem is driven by diversity in high-value verticals. Unlike other ecosystems that may rely heavily on a single industry, Switzerland has successfully diversified its innovation pipeline.

Robotics

Switzerland is the undisputed European leader in robotics. The European Spinouts Report 2025 ranks ETH Zurich as the number one institution in Europe for robotics spinout value creation with EPFL taking the second spot. This establishes the Zurich-Lausanne corridor as the premier axis for robotics innovation on the continent.

This dominance is translating into commercial success. ANYbotics, a spinout from ETH Zurich, recently raised an additional $20 million in September 2025 from Climate Investment, bringing its total funding to over $150 million as it scales its autonomous industrial inspection robots globally

“The rise of Robotics at ETH Zürich was mainly initiated by the introduction of the Master in Robotics, Systems and Control in 2009 and our strong research focus on complete robot systems… It is all about bringing the best, most motivated talents together, in a vibrant ecosystem that offers early-stage startup support.”

Roland Siegwart, Robotics Professor, ETH Zurich

AI and Machine Learning

While often associated with software hubs, Switzerland has carved out a unique position in AI by focusing on high-talent density and core research. The sector is expanding rapidly, now accounting for 23 percent of all new startups created in Switzerland between 2021 and 2025.

Crucially, Switzerland boasts the highest density of AI talent in Europe, hosting 4.8 percent of the core AI talent pool despite having only 1.3 percent of the population. A prime example of this prowess is DeepJudge, an ETH spinout revolutionizing legal search, which closed a $41.2 million Series A round in November 2025 to scale its AI-powered knowledge search platform.

Biotech and Life Sciences

Historically the strongest pillar of Swiss innovation, the life sciences sector remains a robust engine for value creation. In 2025, Biotech and Pharma spinouts across Europe continued to attract the highest volume of capital. Here, EPFL, ETH Zurich, and University of Zurich are named by the authors among Europe’s top hubs.

Switzerland’s contribution is significant, highlighted by the acquisition of Araris Biotech by Taiho Pharmaceutical in March 2025. This transaction, valued at up to $1.1 billion, validates the quality of Swiss academic spinouts, with the Paul Scherrer Institute (PSI) and ETH Zurich technology securing $400 million upfront to advance next-generation antibody-drug conjugates. Araris’ CEO and co-founder Dragan Grabulovski was the subject of one of our recent Success Stories.

Climate Tech & Energy

Perhaps the most promising growth area is Climate Tech, where Swiss institutions are translating hard science into sustainability solutions. ETH Zurich holds the number one position in Europe for spinout value creation in Climate Tech, surpassing even the French CNRS and Technical University of Munich.

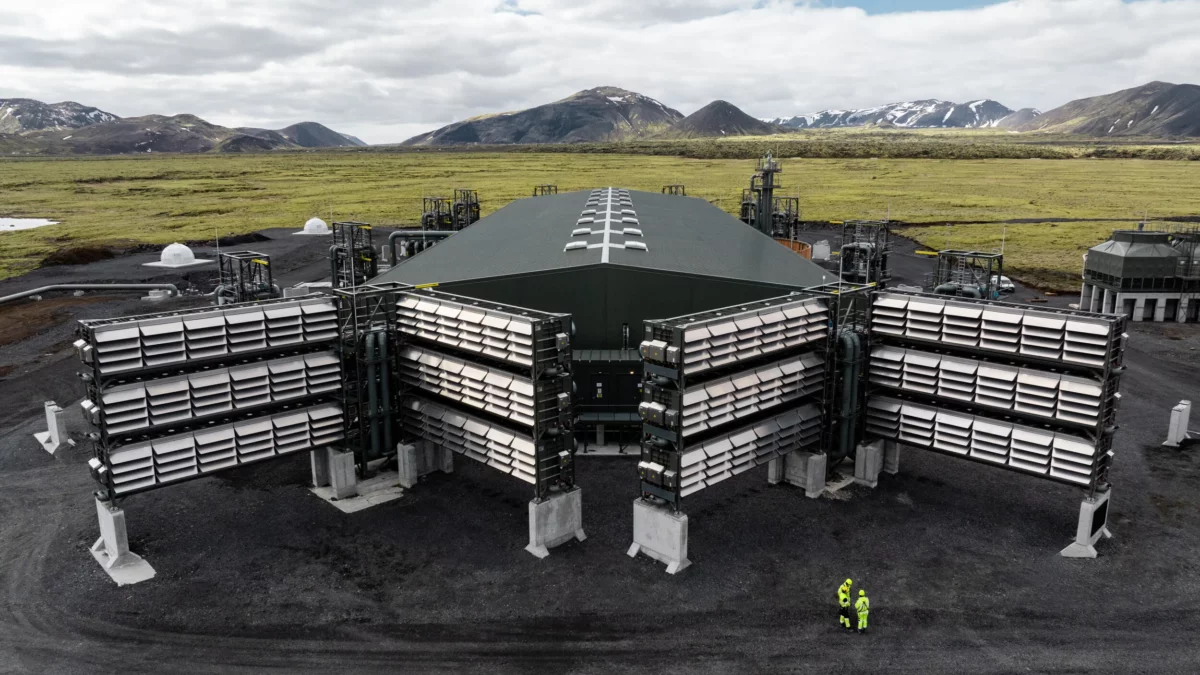

Recent activity confirms this momentum. Corintis, a Lausanne-based startup focusing on sustainable computing, closed a $24 million Series A in September 2025 to scale its microfluidic cooling technology for AI chips, a critical innovation for energy-efficient data centers. Companies like Climeworks and Neustark further exemplify how Swiss engineering is industrializing carbon removal.

Deep Tech Capital Intensity

A defining characteristic of the Swiss ecosystem is its focus. While other regions may dilute their capital across consumer applications or general software, Switzerland directs the majority of its financial resources toward complex engineering and science.

According to the Switzerland Deep Tech Report 2025, 60 percent of all venture capital funding in Switzerland is allocated to deep tech. This is the highest share globally, surpassing Israel (49%), Sweden (44%), and the United States (43%). This figure indicates a sophisticated investor base that is comfortable with long R&D cycles, high technical risk, and significant capital expenditure requirements.

The volume of investment matches this intensity. Swiss deep tech startups raised $1.9 billion in 2024 and are projected to reach $2.3 billion in 2025. This capital is not purely domestic. More than 85 percent of VC funding in Swiss deep tech comes from international investors. This high percentage serves as a global vote of confidence in Swiss technology.

The Gold Standard

The data from 2025 presents a cohesive narrative. Switzerland has successfully transitioned from a niche player to a central pillar of the European deep tech landscape. By focusing on high-complexity and high-value sectors like Robotics, AI, and Biotech, and by leveraging the immense research output of institutions like ETH Zurich and EPFL, the country has built an innovation engine that is unrivaled in its efficiency.

Switzerland’s dominance of the European spinouts scene is not just the fruit of a system that drives bottom-up innovation, but also due to universities like ETH Zurich who are constantly innovating to be the best place to spinout in Europe, as explains Frank Floessel, ETH Zurch’s Head of Entrepreneurship:

The challenge for the coming years will be to maintain this output while addressing the late-stage funding gap. If Switzerland can mobilize more domestic institutional capital to match its technical brilliance, it will not only retain its top ranking but potentially widen the gap with its European peers. Per the report, the European average for domestic funding is much higher than that of Switzerland. For now, the verdict is clear: for deep tech spinouts, Switzerland is the gold standard.

More Content

-

The Relay Node Olivier Laplace, Partner at Vi Partners, still views the world through the structural lens of a software engineer. While his days of…

-

From Relaying to Refunding If Part 1 was about the who – Olivier Laplace as the “relay node” in a vast network -Part 2 is…

-

The Corporate Paradox Olivier Laplace has sat in every seat at the table. He has been the engineer building the product, the banker structuring the…