/

Into the Web with DTN’s Spider Analysis: Where We’re Strong, Where We’re Slow, and What To Do About It

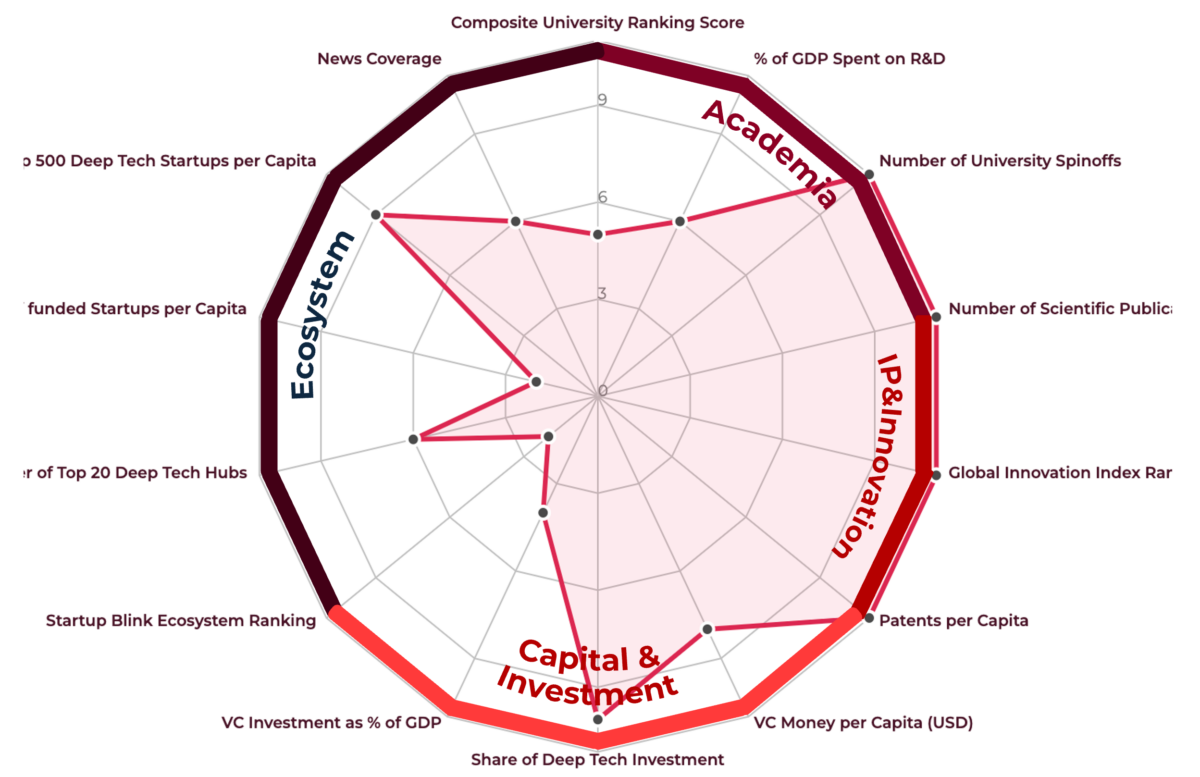

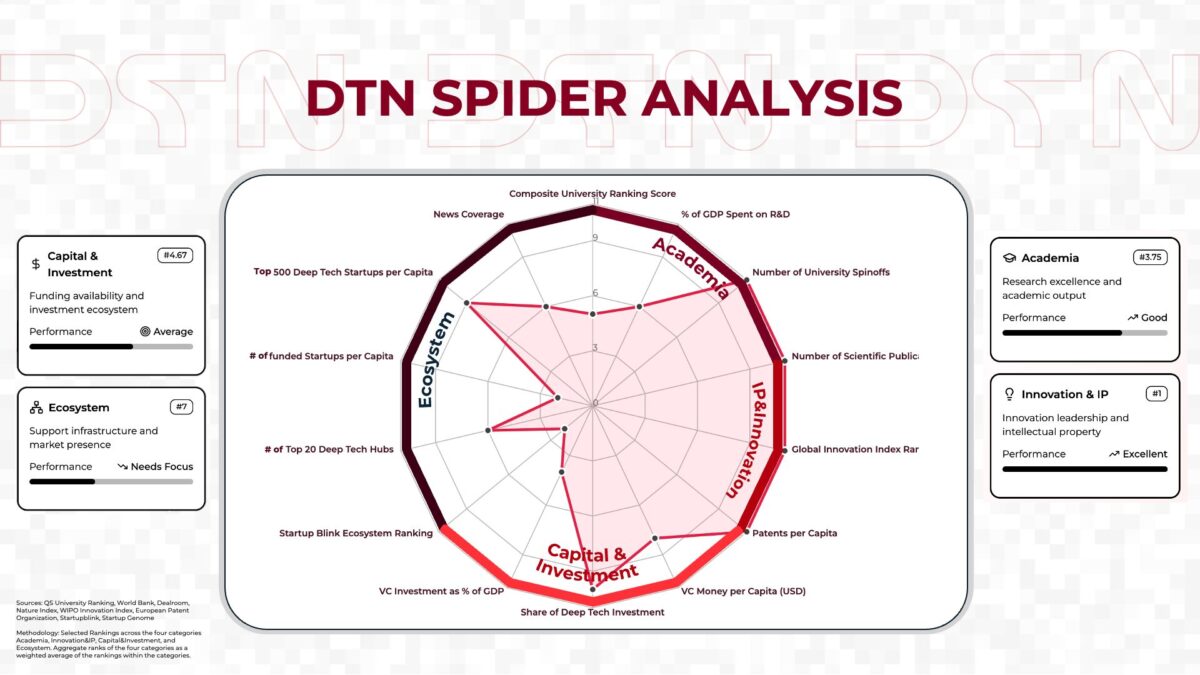

Our new spider graph maps Switzerland’s position across four pillars of deep tech: Innovation & IP, Academia, Ecosystem, and Capital & Investment. A clear picture emerges: Switzerland possesses a solid foundation in academia and innovation, but needs to push for better capital and ecosystem conditions.

The picture at a glance

Innovation & IP: the home turf

Switzerland sits at the #1 spot here, which will shock exactly no one who has ever caught a glimpse of the EPO patent index. With the highest number of patents per capita, as well as the #1 spot of the WIPO Global Innovation Index for the 14th year in a row, Switzerland excels at producing cutting-edge innovations and protecting its intellectual property.

Discover more fascinating stats about Switzerland on our Facts and Figures.

Bottom line: Instead of imagining the typical Swiss with an alphorn in one hand and chocolate in the other, you should get used to an image of a Swiss in a lab coat creating cutting-edge research.

Academia: world class, and continuously expanding

On research intensity and output, Switzerland plays in the Champions League: high R&D as a share of GDP, dense clusters of top researchers, and universities that punch far above their enrolment size. With 80.4 and 93.3 out of 100 points in the QS university ranking respectively, EPFL and ETH not only rank among Europe’s academic thought leaders- they also prove to be spearheading spinout value creation, according to the latest Swiss Deep Tech Report.

With ETH’s and EPFL’s announcement of a joint LLM that runs on the Alps, Switzerland’s biggest supercomputer, as well ETH’s latest expansion to Heilbronn, a new European Mecca for AI research, Switzerland’s academic landscape proves its ability to continuously reinvent itself and stay ahead of the curve.

Bottom line: the science is there. And Switzerland knows how to repackage it into IP-ready innovation.

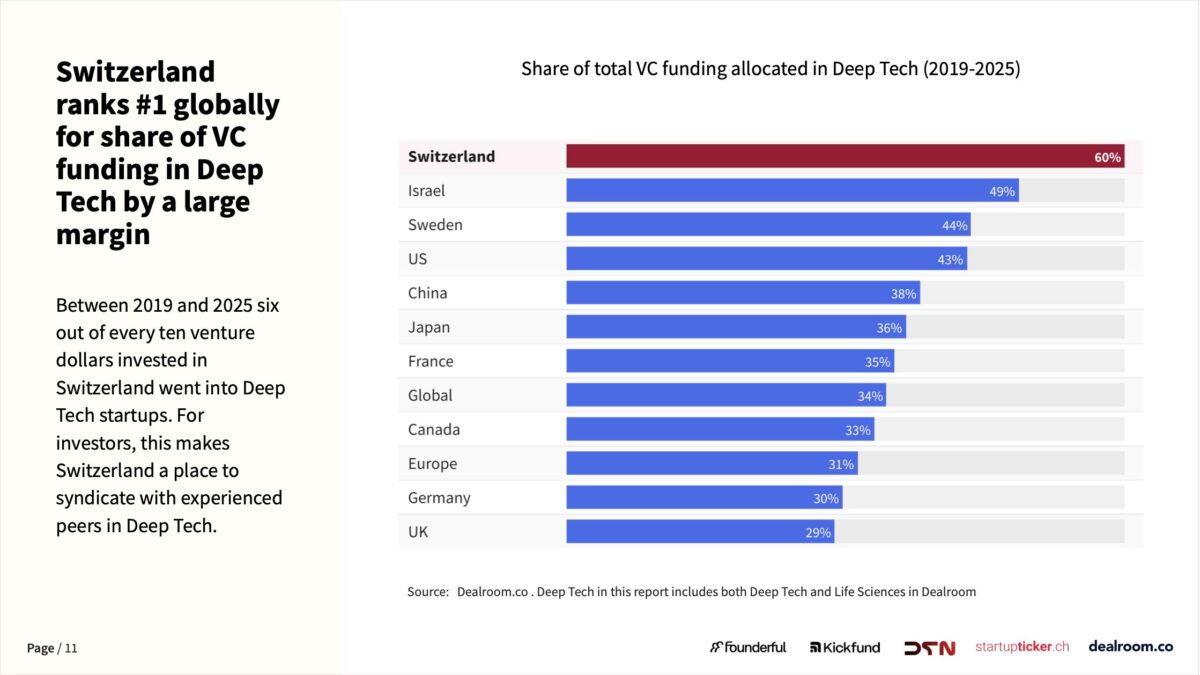

Capital & Investment: decent fuel, wrong nozzle at growth stage

Funding looks “Average.” Early capital has improved and ~60% of VC now targets deep tech, but late-stage firepower still comes mostly from abroad. That’s fine until it isn’t: Of the over $100 billion of value created by Swiss deep tech, $80 billion of that went to foreign investors. When scale rounds set terms and strategy, value capture drifts with them. This is reflected in the low percentage of VC investment as a share of Swiss GDP – it’s almost half as small as the one of the US (3.6% vs 6.9%). Creating deeper domestic pools for B/C rounds, plus recurring mechanisms for secondary liquidity, would stop forcing founders into expensive geography arbitrage.

Bottom line: we raise, but we don’t always retain. We need to build local growth capital and make foreign investors a value added, not a lifeline.

Ecosystem: our weakest link, and the most fixable

This is where the spider thins out. The country underperforms on items like global startup-ecosystem rank, number of top deep tech hubs, and news visibility. Translation: we have concentrated excellence but not enough surface area. Founders still bounce between cantons and continents to find sector peers, late-stage mentors, and customers who’ll sign a first promising contract. We don’t need Silicon-everything; we need a tighter mesh of specialized hubs, mentors that can open domestic and international doors, and a bolder narrative abroad.

The gap is not in talent or inventions but in translation mechanisms. Successful ecosystems like Boston or Tel Aviv benefit from repeat-founder networks, standardized spinout frameworks, and strong corporate procurement pipelines.

Why does innovation and academia excellence not directly translate into the ecosystem? Because “great lab” is not the same as “great launchpad.” We need more predictable spinout paths& standard IP terms, a bigger flywheel of successful founders that empower the ecosystem and framework conditions that understand founder’s needs.

Bottom line: Switzerland isn’t loud- Right now, it’s quietly evolving. But for the revolution, we need noise.

What the spider is telling us to do by 2033

- Double down on IP advantage. Keep fast-track patent support for startup teams and expand specialized prosecution and freedom-to-operate services.

- Grow visible, sector-sharp hubs. Robotics, sensors, energy hardware, and AI-for-industry need recognizable anchors with demo floors, pilot partners, and resident capital.

- Scale domestic growth finance. Co-investment vehicles for late stage, plus patient capital from pensions and insurers, will keep more value at home.

- Turn customers into champions. Public and corporate procurement should budget for first-of-a-kind pilots, with clear risk-sharing rules.

Why it matters

If Switzerland wants the #1 Deep Tech Nation slot by 2033, we can’t just invent the future; we have to host it. The spider shows the recipe is already mostly in the pot: unmatched IP, serious science, growing capital. The missing ingredients are scale muscles and a bigger stage.

Switzerland’s spider is clear: excellence at the core, momentum in capital, and an ecosystem still catching up. Time to widen the web.

Methodology

The composite radar aggregates normalized indicators across four categories: patents and innovation rankings; research output, R&D intensity, and spinouts; ecosystem reach and visibility; and venture depth and allocation to deep tech. Sources include major public datasets and industry trackers (e.g., QS University Rankings, World Bank, WIPO and EPO data, Nature Index, Dealroom, StartupBlink, Startup Genome). Rankings are weighted averages across indicators inside each pillar.

More Content

-

Today marks a defining moment for the Swiss innovation ecosystem. Deep Tech Nation Switzerland officially launching Project Switzerland, a national initiative with a singular, critical…

-

More money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

Impatience is Imperative There is a distinct cultural friction when a Swiss founder steps into the US market. In Switzerland, the prevailing operating system is…