Focus Sectors | Verticals

BioTech

BioTech is the flagship vertical of the Swiss deep tech ecosystem, focused on the discovery and development of novel drugs and therapies to address the world’s most pressing diseases. As a “global hotspot for biotech innovation”, Switzerland has cultivated a complete, mature ecosystem that has generated more venture capital, more startups, and more enterprise value than any other sector.

The nation’s status as a “BioTech powerhouse” is built on two pillars: the “exceptional concentration of pharma expertise around Basel”, home to industry giants like Roche and Novartis, and the world-class academic excellence flowing from its universities. This combination has created a “proven playbook that moves discoveries from lab to high-valued exit”, attracting over 85% of its funding from international investors who recognize the sector’s global appeal and proven track record.

With over 275 active startups and $4.8B in funding since 2019, the Swiss BioTech pipeline is robust and deep. This page provides a comprehensive overview of the investment landscape, the “companies to watch” in this powerhouse sector, and the key hubs that cement Switzerland’s role as a launchpad for world-class biomedical innovation

Key Stats*

275+

VC-Backed startups

$4.8B

VC funding since 2019

$64B

Combined Enterprise Value

Tob Hubs in Basel (pharma hub), Zurich, Lausanne and Geneva.

* All data is taken from the Swiss Deep Tech Report 2025.

Companies to watch

Precision drugs targeting eukaryotic pathogens.

Antibodies targeting inflammation, autoimmunity, and fibrosis.

Medicines for immunologic & inflammatory diseases.

Treatments for obstructive sleep apnea.

Allosteric modulator therapeutics for underserved neurological disorders.

Therapeutic solutions for male and female infertility.

Gene therapy for retinal diseases causing blindness.

Biotechnological solutions targeting muscle for metabolic health.

Revitalizing cells to address age-related and chronic diseases.

«Switzerland has long been a global hotspot for biotech innovation. The exceptional concentration of pharma expertise around Basel, combined with academic excellence and access to capital, continues to make it one of the world’s most fertile grounds for breakthrough biomedical innovation.»

Severin Schwan

Chairman

Roche

«Switzerland is a powerhouse in European innovation, attracting the highest volume of deep-tech capital per capita. BioTech and Life Science continue to stand out as the country’s flagship verticals, powered by a proven playbook that moves discoveries from lab to high-valued exit. International investors supply over 85 percent of all Swiss investments, rising to 96% in large rounds, underscoring Switzerland’s global appeal. Al and ML are gaining ground fast, yet biotech excellence remains the benchmark, cementing the nation’s role as a launchpad for world-class innovation.»

Diego Braguglia

Managing Partner

Vi Partners

Who’s Who in BioTech

-

AGIRE FOUNDATION

Lugano

We are the Innovation Agency of southern Switzerland and we provide support to start-ups and innovative SMEs on their path to growth.

-

Bio-Technopark Schlieren-Zürich

Zurich

The Bio-Technopark is a life science park housing 60 companies and organizations, as well as 80 academic research groups. The park has offices and laboratories.

-

-

Eawag: Swiss Federal Institute of Aquatic Science and Technology

Duebendorf

Eawag is one of the world’s leading aquatic research institutes.

-

ETH Entrepreneurship

Zurich

ETH Entrepreneurship supports, encourages & challenges entrepreneurs & start-ups. It is the leading organization for the ETH Pioneer Fellowship & UPortunity ETH accelerator.

-

-

FONGIT

Geneva

We support entrepreneurs with the expertise, resources and financing they need in transforming innovative ideas into sustainable companies.

-

-

Gebert Rüf Stiftung

Zurich

Foundation’s CHF 15M annual budget helps tech breakthroughs & builds entrepreneurial attitude/innovation interest via education & transfer projects.

-

Greater Geneva Bern area (GGBa)

Lausanne

Greater Geneva Bern area (GGBa) is the official investment promotion agency for Western Switzerland.

-

-

MassChallenge Switzerland

Renens

World’s largest equity-free accelerator, supporting international startups & scaleups across all sectors through mentoring, curriculum & strong global corporate connections.

Most Active Swiss VCs in BioTech*

-

Business Angels Switzerland

Focus on early stage

ICT

-

Forty:one

Focus on early growth

ICT

-

Occident

Focus on early growth

Medtech

Participated in funding round of >100 mio.

-

Pureos bioventures

All stages

Biotech

Participated in funding round of >100 mio.

Invested in Unicorn

-

Redalpine Ventures

All stages

Biotech

Participated in funding round of >100 mio.

Invested in Unicorn

-

SICTIC

Focus on early stage

ICT

-

Swisscanto

Focus on later stage

ICT

Participated in funding round of >100 mio.

Invested in Unicorn

-

Verve Ventures

All stages

Medtech

-

VI partners

Focus on early stage

ICT

Participated in funding round of >100 mio.

Invested in Unicorn

-

Zürcher Kantonalbank

Focus on early stage

ICT

Invested in Unicorn

*List established by startupticker.ch based on number of investments in a given vertical

Success Stories

-

Read more: Switzerland: A Leading Global Scale-up Hub

Read more: Switzerland: A Leading Global Scale-up HubMore money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

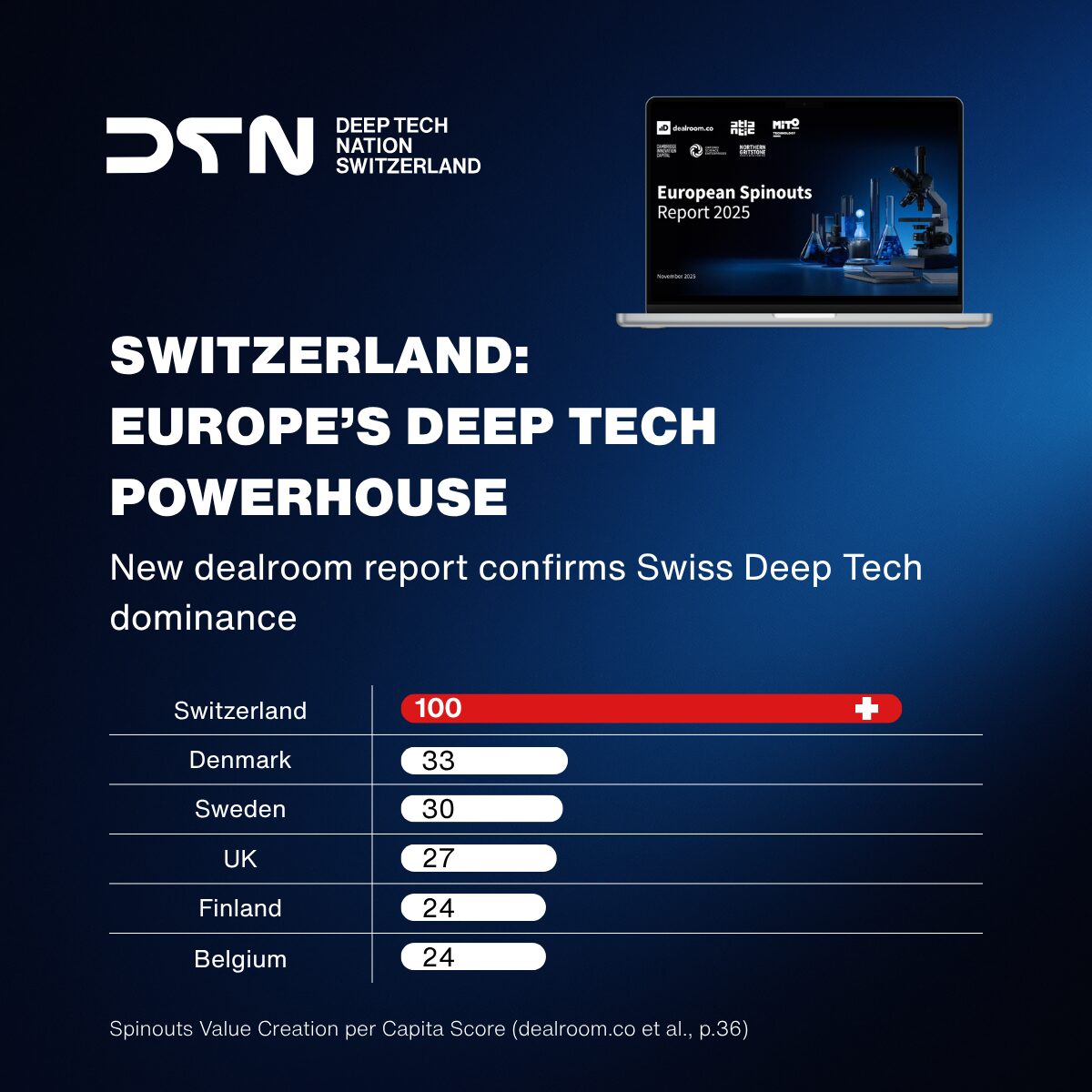

Read more: European Spinouts Report 2025: Switzerland Confirmed as Europe’s Deep Tech Powerhouse

Read more: European Spinouts Report 2025: Switzerland Confirmed as Europe’s Deep Tech PowerhouseThe most critical metric in innovation is not volume but efficiency. While larger economies naturally produce higher absolute numbers of companies, the true measure of…

-

Read more: Why Deep Tech Pioneers and Private Equity are a Match

Read more: Why Deep Tech Pioneers and Private Equity are a MatchThis autumn saw notable activity from private equity investors in Switzerland, including a USD 500 million exit in addition to investments. Their preference for innovative…

Biotech

News

-

CHF 10 million seed funding and new board chair for TECregen

TECregen, a Basel-based biotech company pioneering thymus regeneration, has secured CHF 10 million in a seed financing round led by the Boehringer Ingelheim Venture Fund…

startupticker.ch

-

Significant Advances in Pharmaceutical Pipelines for Underserved Diseases

Oculis, Legacy Healthcare and Neurosterix are advancing their drug pipelines with major clinical milestones. Oculis’ Privosegtor received breakthrough therapy designation from the U.S. Food and…

startupticker.ch

-

FoRx Therapeutics raises $50 million to advance clinical trials

In August this year, FoRx Therapeutic initiated its first human trial Phase 1 clinical development of its lead drug candidate, FORX-428, designed to target and…

startupticker.ch

-

SK Capital acquires majority stake in Swixx Biopharma at EUR 1.5 billion valuation

HBM Healthcare Investments, together with the founders and other shareholders such as Mérieux Equity Partners, will sell a majority of their current stake in Swixx…

startupticker.ch

-

Xlife Sciences AG announces exit of 12 project companies to Grupo Landsteiner

Mexican Grupo Landsteiner has signed a binding framework to acquire 12 of Xlife Sciences’ advanced biotech, medtech and digital health projects for a total of…

startupticker.ch

-

Wellcome awards CHF 14 million for BioVersys’ BV100 Phase 2b study

BioVersys’ lead asset BV100, an innovative anti-infective developed for hospital infections caused by Acinetobacter baumannii, including carbapenem resistant strains (CRAB), has been selected to participate…

startupticker.ch

FAQ on Swiss Enterprise Software

1. Why is Switzerland a global powerhouse for BioTech investment?

Switzerland is a “global hotspot for biotech innovation” and a “powerhouse in European innovation”. It combines a high concentration of pharma expertise in Basel, academic excellence, and a “proven playbook” for moving discoveries from the lab to high-value exits

2. What is the “BioTech playbook” for Swiss startups?

It refers to the well-established path for Swiss BioTechs: spinning out of world-class academic labs, raising capital from experienced local and international VCs

, and progressing toward a high-value exit (M&A or IPO), a path proven by numerous successful companies.

3. What is the role of Basel in the global BioTech industry?

Basel is one of the world’s most important life science hubs, often called the “pharma capital.”. It is home to the global headquarters of Roche and Novartis, creating an “exceptional concentration of pharma expertise” that fuels the entire startup ecosystem.

4. How much venture capital has been invested in Swiss BioTech?

Swiss BioTech startups have raised $4.8 billion since 2019. 2024 was the most active year ever for BioTech funding. This sector alone has generated over $63.7 billion in enterprise value.