Focus Sectors | Verticals

Climate Tech & Energy

Why Switzerland for climate tech

The global energy transition has created one of the largest and most urgent investment opportunities in history. The Climate Tech & Energy vertical is focused on developing and scaling sustainable solutions to reduce emissions and environmental impact across all sectors. This includes innovations in energy storage, carbon removal, sustainable materials, and advanced industrial processes.

Switzerland is a world leader in this mission, blending “deep science, pragmatic engineering, and purpose-driven capital” to create globally relevant companies like Climeworks and Neustark. With over 120 VC-backed startups and $1.6 billion in funding since 2019, the Swiss ecosystem has a proven track record of transforming complex science into industrial-scale solutions that can restore the planet.

This page showcases the innovators turning the climate challenge into a technological opportunity. Explore the diverse landscape of Swiss climate tech, discover the “companies to watch” in areas from green hydrogen to biomanufacturing, and learn why Switzerland’s relevance as a hub for industrial technologies has “never been greater”

Key Stats*

120+

VC-Backed startups

$1.6B

VC funding since 2019

$4.7B

Combined Enterprise Value

Tob Hubs in Zurich (ETH), Lausanne (EPFL) and Geneva (CERN).

* All data is taken from the Swiss Deep Tech Report 2025.

Companies to watch

Multilayer curtain coating for batteries.

Sustainable chemical waste treatment.

Precision fermentation for multifunctional emulsion.

Organic binder products for construction.

Sustainable aviation fuel.

Green Hydrogen.

Fermentation platform for biomanufacturing.

Biomaterials.

Stationary energy storage.

«Swiss Sustainable Tech blends deep science, pragmatic engineering and purpose-driven capital. This fertile ecosystem lets Ecorobotix and its peers transform robotics and Al into everyday tools that feed people and restore the planet.»

Dominique Megret

CEO

Ecorobotix

«Being part of the Swiss and global tech ecosystem for more than 25 years, one thing is clear: the relevance of Switzerland as a hub for industrial technologies has never been greater. Energy storage, gas separation, water filtration, chemical technologies, hydrogen, carbon removal, precision fermentation are just a few of the many applications that see Swiss startups with global relevance, and working with global corporations, we can see how the interest in Swiss tech has tremendously increased in recent years.»

Gina Domanig

Managing Partner

Emerald Technology Ventures

Who’s Who in Climate Tech & Energy

-

Bluelion Foundation

Zurich

We are a leading Tech Startup Hub & community in Zurich, supporting founders with everything they need to grow successful tech startups.

-

Boldbrain Startup Challenge

Lugano

Boldbrain Startup Challenge is an accelerator designed for early-stage startups and entrepreneurs with innovative ideas, ready to launch and develop their business from Canton Ticino.

-

-

-

Eawag: Swiss Federal Institute of Aquatic Science and Technology

Duebendorf

Eawag is one of the world’s leading aquatic research institutes.

-

EPFL Innovation Park

Lausanne

EPFL Innovation Park: A hive of interaction between academia and business, attracting outstanding, innovative projects and empowering them to flourish, scale up and transform society.

-

Gebert Rüf Stiftung

Zurich

Foundation’s CHF 15M annual budget helps tech breakthroughs & builds entrepreneurial attitude/innovation interest via education & transfer projects.

-

Most Active Swiss VCs in Climate Tech & Energy

-

Swisscom Ventures

Focus on later stage

ICT

Participated in funding round of >100 mio.

Invested in Unicorn

Data-based insights

Scaleup wave ahead

The Swiss cleantech scene is much younger than the biotech or ICT ecosystem. It was not until 2017 that rapid growth began, preceded by the Paris Climate Agreement and a new energy law in Switzerland. In addition, support for innovative companies in the cleantech sector was strengthened.

The result was a doubling of the number of new companies founded each year and a steep increase in investments. In the last five years, USD 2.5 billion of venture capital has gone into Swiss startups, compared with just over USD 250 million in the previous five-year period. The number of financing rounds has also increased year on year, rising to 70 in 2024.

The short history of the sector means that on average startups are still young, but they are well advanced in product development. According to the Swiss Cleantech Report, half already have proven products. Investors looking for companies that are ready for scaleup can now fully benefit from the rising wave of young companies founded after 2017.

Close ties to the US

The largest Swiss venture capital financing round of all time was secured by a cleantech company: Zurich startup Climeworks, a pioneer in direct air capture and storage (DAC+S) technology, received USD 650 million in 2022. The following year, it caused something of a stir with its successful expansion into the US. Participation in the US government’s Regional Direct Air Capture Hubs programme played a central role in this.

Energy Vault, which has developed a large-scale system – EVx – to store energy using gravity, is another Swiss company that been able to raise several hundred million dollars from investors. EVx was included in TIME’s Best Inventions 2024 list and Energy Vault chose the New York Stock Exchange for its IPO in 2022.

These close ties to the US are not isolated cases: 35% of Swiss cleantech startups describe the US as one of their core target markets and thus it is more important than neighbouring countries such as Italy or Austria. This is in line with with the orientation of the entire Swiss export economy: for several years now, the US has been Switzerland’s most important trading partner in terms of export volume, ahead of Germany.

Support from politics

Switzerland is cautious when it comes to financial support for startups; however, an exception is made for cleantech companies. The Technology Fund, launched in 2014, has had a particularly big impact. It offers loan guarantees to Swiss companies with novel products that contribute to a sustainable reduction in greenhouse gas emissions. The portfolio currently includes 150 innovative Swiss companies, and loan guarantees amounting to USD 300 million give these companies access to attractive bank loans. Further funding for innovative projects is awarded by the Federal Office for the Environment and money also comes from private initiatives, such as the Swiss Climate Foundation.

This support has contributed significantly to the strong increase in startups and investments since 2017, with about USD 1.5 billion invested in the Technology Fund’s portfolio companies alone. Support measures reduce the risks for founders and investors, particularly in the risky and capital-intensive cleantech business, and thus create incentives to start and finance companies.

Success Stories

-

Read more: Switzerland: A Leading Global Scale-up Hub

Read more: Switzerland: A Leading Global Scale-up HubMore money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

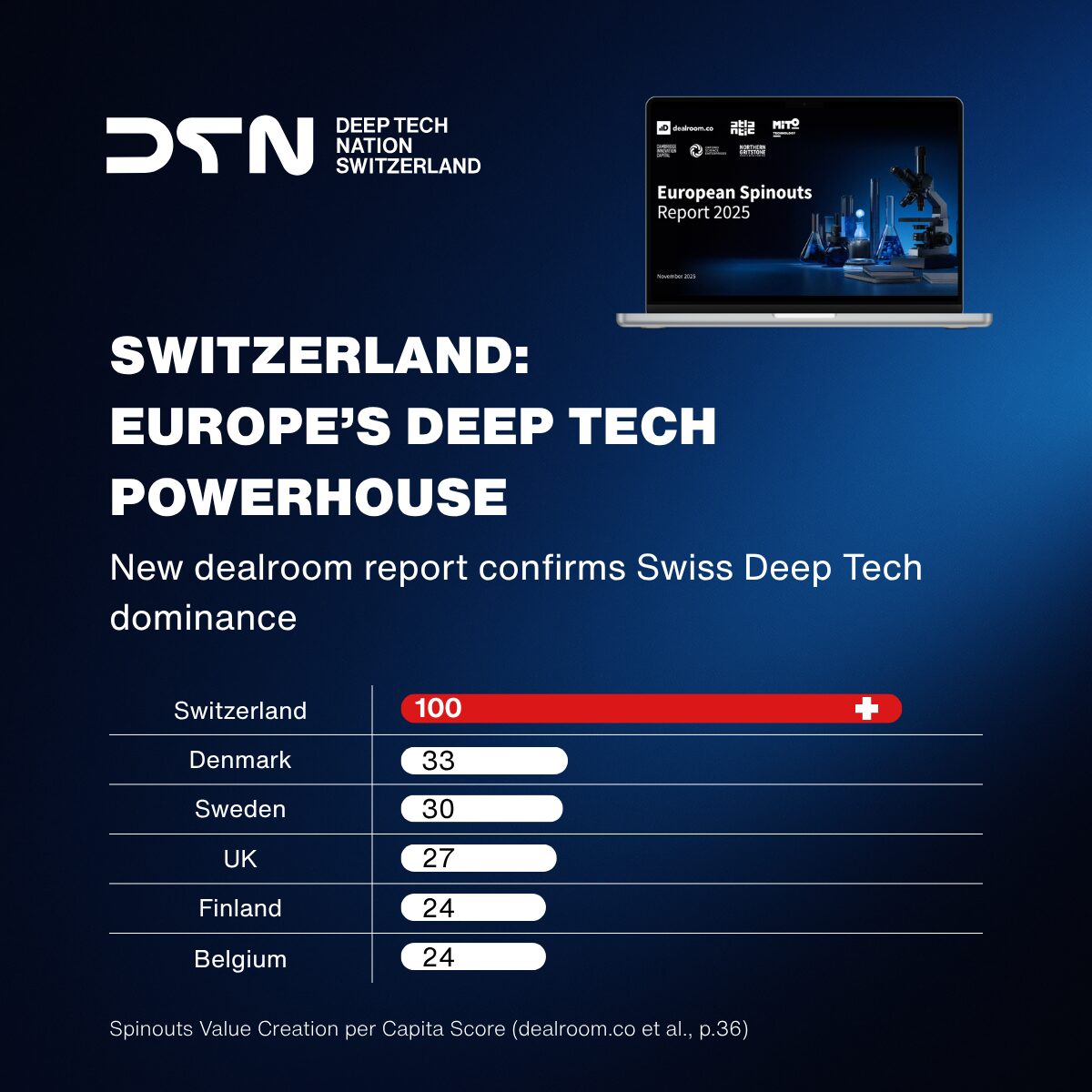

Read more: European Spinouts Report 2025: Switzerland Confirmed as Europe’s Deep Tech Powerhouse

Read more: European Spinouts Report 2025: Switzerland Confirmed as Europe’s Deep Tech PowerhouseThe most critical metric in innovation is not volume but efficiency. While larger economies naturally produce higher absolute numbers of companies, the true measure of…

-

Read more: Why Deep Tech Pioneers and Private Equity are a Match

Read more: Why Deep Tech Pioneers and Private Equity are a MatchThis autumn saw notable activity from private equity investors in Switzerland, including a USD 500 million exit in addition to investments. Their preference for innovative…

Climate Tech & Energy

News

-

Swiss delegation warms up for CES 2026 in Las Vegas

The upcoming year will again kick off with the annual Consumer Electronic Show (CES) in Las Vegas, held on 6-9 January 2026. Close to 150’000…

startupticker.ch

-

Startups score prizes across Asia and Germany

In recognition of their innovative solutions — from digitally printed solar cells and scenario-based modelling to sono-instruments and solar fuels — juries in Taiwan, the…

startupticker.ch

-

A further USD 25 million for Corintis

Following the closing of a 24M USD Series A earlier this year, Corintis has secured additional $25M Series A1 funding round led by Applied Digital.…

startupticker.ch

-

Swisspod unveils world’s largest hyperloop and secures $13 million

During its second U.S. Hyperloop Day event in Colorado, Swisspod unveiled the world’s largest hyperloop test track, presenting Aerys 1, its first hyperloop capsule model,…

startupticker.ch

-

Swiss startups across industries in the global spotlight

A host of awards were bestowed upon Swiss startups developing innovative solutions across sectors such as medtech, robotics, energy, and fashion. Along with cash prizes,…

startupticker.ch

-

BE WTR wins strategic investor to grow in France

BE WTR France, the subsidiary of the Swiss premium, filtered, local and sustainable water brand, and Cafés Richard, France’s leading coffee supplier for the hospitality…

startupticker.ch

FAQ on Climate Tech and Energy

1. What are the main investment opportunities in Swiss Climate Tech?

The ecosystem has proven global strength in carbon removal (Climeworks, Neustark)

, energy storage (Unbound Potential), sustainable aviation fuel (Metafuels), green hydrogen (NovaMea), and precision fermentation (Cosaic).

2. Which are the most successful Swiss carbon removal companies?

Switzerland is the undisputed global leader in Direct Air Capture and carbon storage. It is home to Climeworks, a unicorn and the most-funded company in the sector, and Neustark, a future unicorn commercializing mineralization.

3. How does Switzerland turn deep science into industrial climate solutions?

The ecosystem “blends deep science, pragmatic engineering and purpose-driven capital”. As noted by Emerald Technology Ventures, “the relevance of Switzerland as a hub for industrial technologies has never been greater”, with global corporations increasingly seeking out Swiss tech.

4. What is the total VC funding for Climate Tech in Switzerland?

Swiss Climate Tech & Energy startups have raised $1.6 billion since 2019. The sector has produced two unicorns (Climeworks, Energy Vault) and has a deep pipeline of over 120 VC-backed startups.

5. Who are the rising stars in Swiss green hydrogen and energy storage?

The next generation of companies to watch includes Unbound Potential (long-duration energy storage), NovaMea (green hydrogen), 8inks (battery manufacturing), and metafuels (sustainable aviation fuel).

6. What role do Swiss universities play in creating Climate Tech startups?

ETH Zurich and EPFL are major sources of Climate Tech innovation, spinning off research in areas like gas separation, chemical technologies, hydrogen, and carbon removal.