The Goeld(i) Standard

Andreas Goeldi has sat on both sides of the investor’s table. With an entrepreneurial track record of over 20 years, including three startups, with one growing to over 550 employees, the words scaling, product-market-fit and deep tech aren’t just buzzwords for him – they are the demarcations of the world in which he supports, invests and breathes.

From HSG to PMF

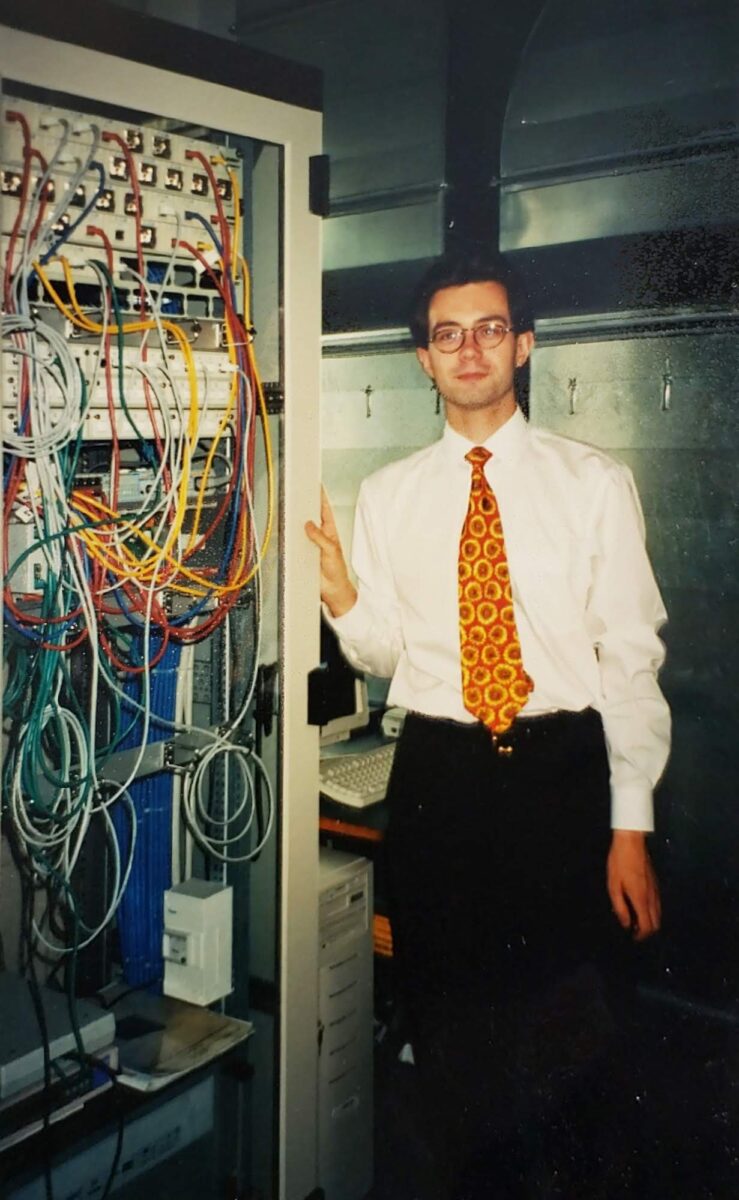

On paper, Goeldi is a business guy – Master’s in Information Management from HSG in 1996 and a Master’s in Management of Technology from MIT in 2007. But in practice, a prized possession from his childhood gave him the technical expertise he needed to build his ventures: “I started programming when I was 12. I was the first kid in my area with a home computer, and back then you had to program yourself. There wasn’t really anything interesting to do with the earliest computers.” His first programming jobs followed when he was in high school. But when it was time to choose a major, he actively decided against a pure computer science degree- “I was always very technical, but I was also very interested in the business side of things. Back then, the University of St. Gallen offered the Information Management program that really brought both of my passions together.”

Today, the University of St. Gallen offers a pure computer science bachelor with a perspective of what it does best: turning ideas and inventions into robust business cases. Goeldi looks positively at these developments: “It’s been a long time coming – combining HSG’s business expertise with the emerging computer science knowledge of ETH Zurich and EPFL really leverages the biggest potential we have here in Switzerland to bring together. Common executive MBA programs make use of the geographical proximity, but also bridge the gap between the technical knowledge to build a great product and the business expertise to bring it to market.”

New Time Zones, New Playbooks

After he founded and scaled a startup in Switzerland, which eventually grew to over 550 employees across Switzerland and Germany, Goeldi crossed the Atlantic Ocean to found another venture in social media analytics. This experience, and his subsequent role as CTO at Pixability equipped him with the agility and knowledge to conquer the U.S. market, a market that is not as homogeneous as many of his portfolio companies think. “When a European company expands to the U.S., they often think that hiring a sales guy in New York will be enough to cover a whole country of 340 million people. Doing business in Texas is different than doing it in Silicon Valley, and these different ways of forming connections can make or break a U.S. expansion.”

Active but not Annoying

With this kind of expertise, Goeldi returned to Switzerland in 2018. That’s when he switched his seat at the investor’s table to become partner at b2venture. But it was not the first time Goeldi wrote a check – after the successful exit of Namics in the early 2000s, he became an angel investor throughout his entrepreneurial career. That facilitated the transition to his new role. When asked about the biggest challenge of becoming an investor after being an entrepreneur, he answers: “As a previous founder, you always have the instinct to get deeply involved in the operational details. There are moments when I have to hold myself back from trying to solve every problem. You can coach the founders, you can open some doors, but ultimately, you need to let them run their business. When I was an entrepreneur, I also had some investors that tried to step in at every step of the way – I respect the founders’ time very deeply and just because their competitor was mentioned in a TechCrunch article, I am not going to call you on a Sunday at 5am to ask you about how you will adapt your strategy. Because that is what a strategy is for: to not be distracted by the noise. I trust that the founders I work with will come to me when they have a problem to solve that I can help them with. I tell founders that we at b2venture are an active but not annoying investor.”

To be an active, but not an annoying investor, Goeldi only works with companies where he has a reasonably deep understanding of the underlying technology and market. His expertise lies in giving strategic advice about how to crack a specific market or talk to a specific customer. But having been in the same shoes, Goeldi also sees himself as a support on a more personal level: “Another aspect where I believe I can help is because I have built a few companies, I know the difficulties that come with it, and I can empathize with the founders. Building a company is hard and having that mental support in difficult times is crucial. Financials are important, but when your investor knocks on your door with a spreadsheet and a red marker when things are looking bleak instead of offering their support, they clearly lack an understanding of startup dynamics.”

The dreadful 50

Goeldi identifies a clear growth inflection point when things start to get tough in a startup: “One rule of thumb is that whenever you hit about 50 people on your hiring path, things always get complicated. I’ve seen this in every single company, including my own. In my third company, I knew, OK, we’re at 40 people, the next year is really going to be terrible because I saw the dreadful 50 on the horizon.”

Goeldi is talking about a problem many scaleups face in Switzerland: At a certain point in the startup journey, it is not only the product that needs to prove itself, but the company structure itself. “Scaling adds a whole other layer of complexity and management. Roles are changing for people who have been there for a while. Suddenly they might find themselves as underlings of people who have joined the company more recently – that leads to friction, and these structural, organizational and cultural tensions are often underestimated.”

Swiss Brains, Missing Manuals

While Switzerland’s technical talent density outpaces every other country around it (according to the Swiss Deep Tech Report, Switzerland ranks #1 in AI talent density in Europe), business scaling expertise is more scarce. “When I was working at Pixability in Boston, we needed a new CFO who was going to navigate our scaling process in that specific vertical. The person we chose had already scaled four companies from Series B to an exit – but ultimately, we had a choice of extremely qualified candidates. These people barely exist in Europe – and the investor’s expertise is also quite spotty. While some of the more experienced and larger funds might have some of the expertise, many younger ones don’t. If we lack on both the executive’s and the investor’s side in terms of scaleup knowledge, growing a company becomes a series of pitfalls.”

Not only is the lacking knowledge a problem, but also the missing peer exchange among leadership roles. “As a founder of a small startup in Boston, roundtables were common practice. And even there, you had people like the CTO of HubSpot who were to explain to you how to grow an engineering team of 5 to 500. Knowledge diffusion like that is paramount for a thriving ecosystem. And I would wish for Switzerland to see more communities like that.”

If you want to know about Andreas Goeldi’s investment successes, what he looks for as an investor and what mistakes he has learned from, check out the next piece “Backed to the Future”.

More about b2venture

-

From ETH labs to global markets: Andreas Goeldi backs Swiss deep tech startups like Ledgy and LatticeFlow AI, proving timing is everything.

-

From Zurich AI hubs to US expansion, Andreas Goeldi of b2venture shares how Swiss startups can scale abroad while keeping their European DNA intact.