/

Beyond Early Stage: The Rise of the Swiss Scale Up Engine

For years, the global narrative regarding European innovation has been consistent: excellent research, strong early-stage formation, but a fragmentation that hampers growth. However, new data suggests this narrative is outdated when applied to Switzerland. The release of the Swiss Startup Radar 2025/2026 confirms a critical maturity signal for our market. Switzerland has evolved from a seed-stage incubator into a reliable global engine for the Swiss scale up segment.

For international investors, this evolution presents a structural arbitrage opportunity. The data reveals a market where capital efficiency meets high-value output, specifically in the deep tech sector. At the Deep Tech Nation Switzerland Foundation, our mandate is to close the growth gap, and the latest metrics indicate that the ecosystem is already delivering on this promise.

The Swiss start-up ecosystem is at a crucial juncture : although the pace of new business creation is high, only a small fraction of these companies grow beyond the confines of a small or medium-sized enterprise (SME). Almost 90% of start-ups remain small, while just over 10%, as scale-ups, are the real drivers of growth. They attract the lion’s share of venture capital, create an above-average number of jobs and shape the economic impact of Switzerland as a start-up location

Pascale Vonmont, President of the Board of Trustees, Startupticker Foundation

A Structural Shift Toward Growth

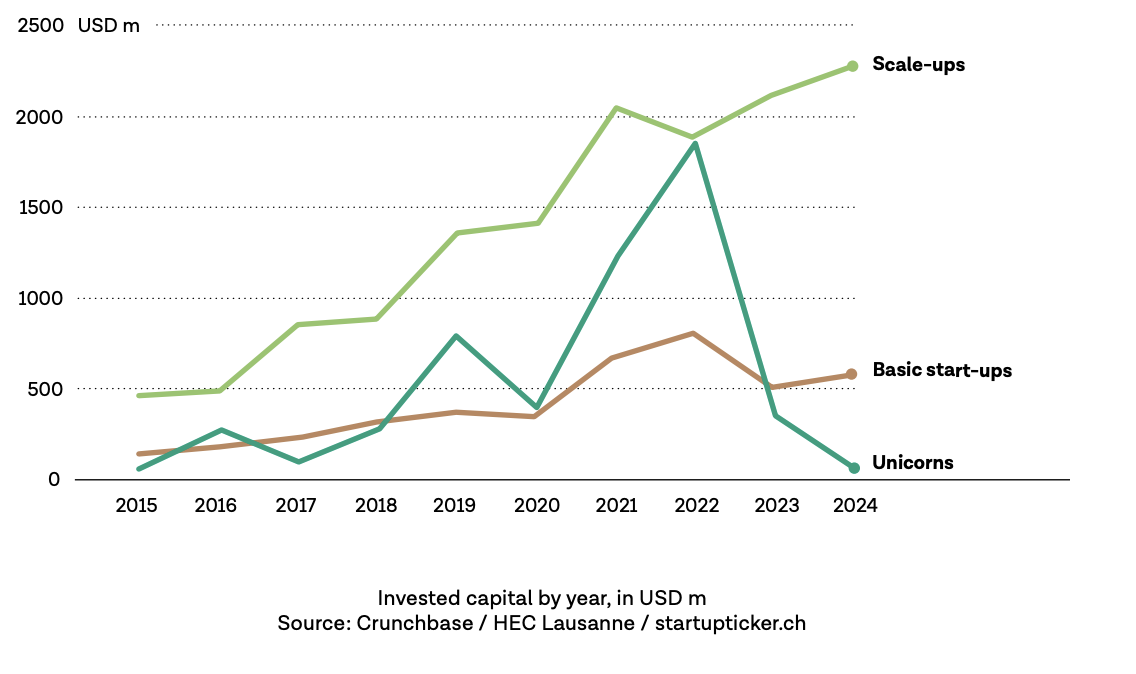

The most significant finding in the current market analysis is the resilience and expansion of growth-stage companies. While global venture capital markets faced significant headwinds and contraction over the last 24 months, the Swiss ecosystem demonstrated a decoupling from these negative trends in its growth segment.

The report categorizes a Swiss scale up as a company that has raised more than USD 20 million in venture capital or achieved a valuation exceeding USD 50 million. This segment is no longer a niche anomaly; it has become the primary driver of the ecosystem’s financial volume.

- Capital invested in Swiss scale-ups has increased nearly fivefold between 2015 and 2024.

- Scale-ups now attract approximately 60% of all venture capital flowing into Switzerland.

- These companies are responsible for substantial job creation, with 45% of scale-ups employing more than 50 people, compared to only 8% of basic startups.

This data indicates that the “scale-up gap” is closing, not due to hype, but due to the fundamental strength of the underlying assets.

Deep Tech: The Asset Class of the Future

Unlike other global innovation hubs that may be heavily weighted toward consumer applications or e-commerce, the Swiss market is overwhelmingly specialized. Switzerland ranks number one in Europe and number three globally for deep tech venture capital investment per capita.

This specialization creates a distinct asset profile for the Swiss scale up. These companies are rarely built on transient consumer trends. Instead, they are built on proprietary intellectual property and scientific breakthroughs.

- 60% of all venture capital in Switzerland is deployed into Deep Tech companies.

- There is a direct correlation between scientific rigor and valuation: over 50% of Swiss unicorn founders hold a PhD.

- Deep tech founders in Switzerland are significantly more likely to possess advanced academic degrees than their international counterparts.

For the Swiss innovation ecosystem, this academic rigor translates into a “moat” around these businesses. The technology risk is often front-loaded, meaning that companies reaching the scale-up phase have already survived rigorous technical validation. This isn’t theoretical, the recently published European Spinouts Report clearly highlights how spinouts from Swiss universities proportionally create the most value in Europe.

The “Unicorn Gap” Opportunity

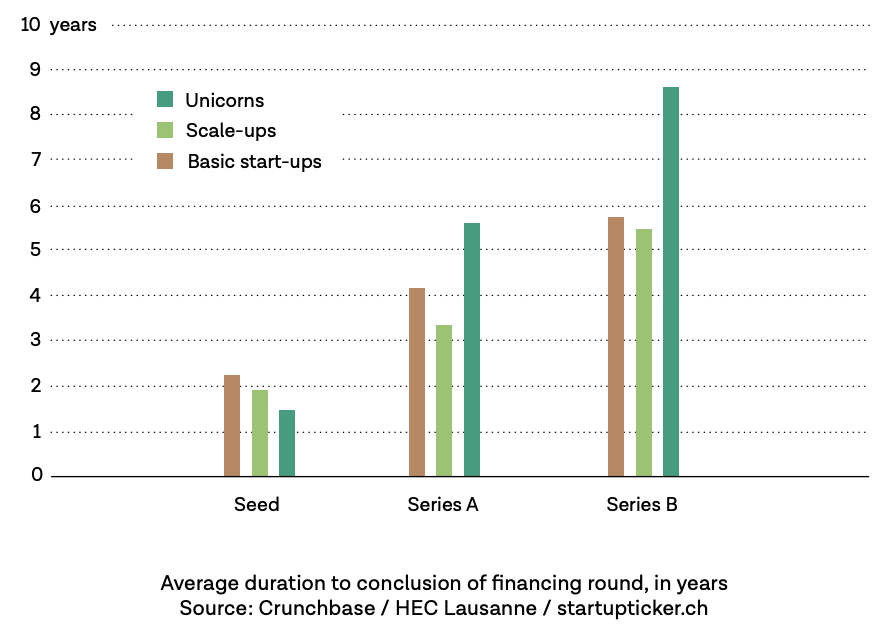

The report highlights a specific financing dynamic that investors should view as an entry signal. Swiss deep tech ventures typically take longer to raise their first major funding rounds compared to peers in the US or UK.

While a US startup might rush to a Series A, a Swiss deep tech venture spends an average of 3.2 years reaching its first significant funding, compared to less than two years for global averages. This time is utilized to capital-efficiently de-risk complex technologies before aggressive commercial scaling begins.

This creates a highly attractive entry window:

- Technology Risk: Significantly lower, as the core R&D has been validated over a longer gestation period.

- Capital Demand: High, as the company pivots to global commercialization.

- Valuation: Often more rational than in overheated markets, as capital efficiency is baked into the company’s DNA.

Unicorn investors, defined as funds that have previously backed billion-dollar companies, are already active in this space, recognizing that the Swiss scale up represents a de-risked asset with high upside potential.

Overtaking the US in Per Capita Efficiency

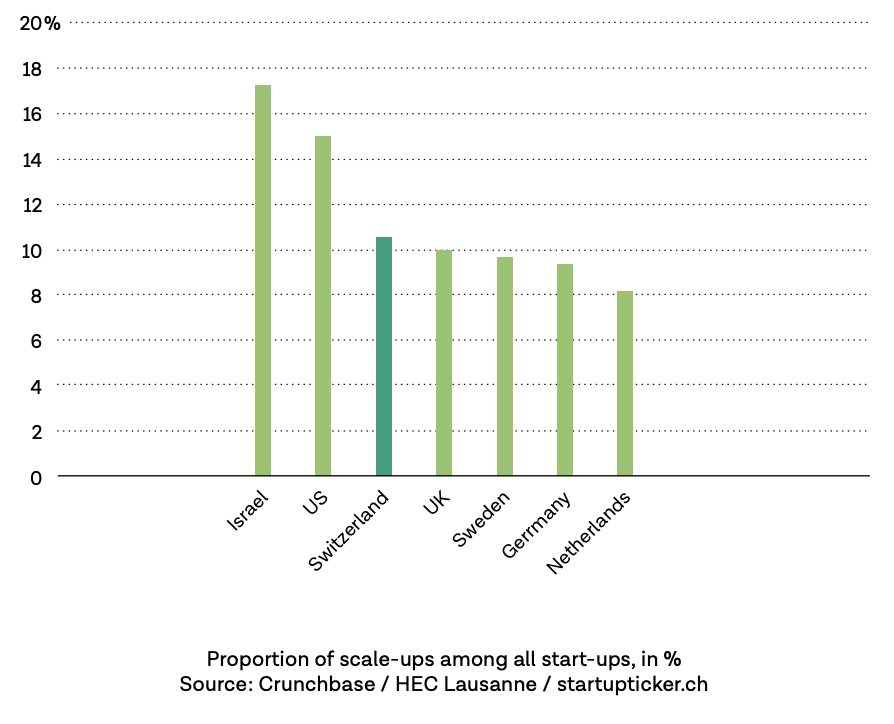

Perhaps the most striking metric from the 2024 data is the comparison with the United States. While the US remains the largest absolute market, Switzerland has surpassed it in relative efficiency regarding growth capital.

In 2024, Switzerland overtook the USA in terms of capital invested per capita in the scale-up segment. This is not merely a statistic; it is evidence of a maturing asset class that can absorb and deploy significant capital.

However, a gap remains. While international investors already contribute over 80% of the capital for Swiss unicorns, there is room for more strategic capital deployment at the growth stage. The ecosystem is producing high-quality targets faster than domestic capital can support them, creating a prime environment for international lead investors.

Bullish on Swiss Deep Tech

The Swiss ecosystem has matured. We are no longer just feeding the roots of innovation; we are reaping the harvest. The science is world-class, the early-stage discipline is unmatched, and the pipeline of a valid Swiss scale up is now delivering consistent, high-value opportunities.

We invite investors to examine the full data set. The question is no longer whether Swiss deep tech can scale, but who will capitalize on its global expansion.

Find startupticker.ch’s summary here, and the full report here. Looking for more reports and resources about the Swiss deep tech ecosystem? Check out our Knowledge Base here.

More Content

-

Today marks a defining moment for the Swiss innovation ecosystem. Deep Tech Nation Switzerland officially launching Project Switzerland, a national initiative with a singular, critical…

-

More money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

Impatience is Imperative There is a distinct cultural friction when a Swiss founder steps into the US market. In Switzerland, the prevailing operating system is…