/

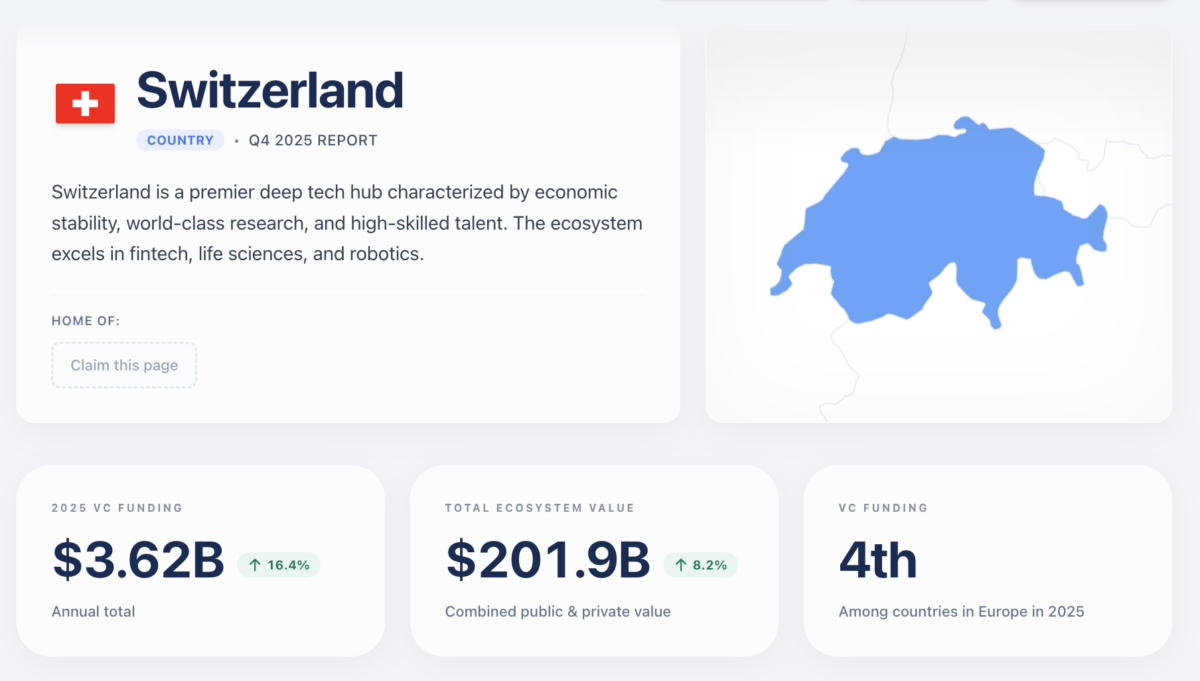

Switzerland Ranks 4th in Europe for VC Investment While Leading Per-Capita Deep Tech Innovation

Note: Absolute investment figures in this article are based on preliminary Dealroom data and may contain inaccuracies. For verified Swiss VC data, see Startupticker’s Venture Capital Report on February 3, 2026.

Dealroom’s Q4 2025 Quarterly Investment Report reveals a compelling paradox about Switzerland’s innovation landscape. While the country placed fourth in Europe, per-capita metrics and sectoral performance tell a different story. Using the Quarterly Investment Report, the 2025 Spinout Report, and the 2025 Swiss Deep Tech Report, we demonstrate that Switzerland has built Europe’s most efficient deep tech ecosystem, translating academic excellence into commercial outcomes at an unmatched rate. While we will refrain from qualifying the overall capital investment, as the numbers are still unverified.

The Rankings at a Glance

- Total ecosystem value reached nearly $202 billion (up over 8%)

- The country leads Europe in Robotics (over $280 million)

- Swiss hubs demonstrate strong momentum, especially in Zurich, Vaud, and Basel.

- 39 unicorns and over 20,000 companies reflect ecosystem maturity

All of this data and much more can be found on dealroom.co’s Quarterly Investment Report – Q4 2025

Switzerland’s European Standing: Beyond Absolute Rankings

Switzerland’s fourth-place ranking in European VC funding tells only part of the story. The country trails the UK (over $23 billion), Germany (over $8 billion), and France (nearly $8 billion) in absolute volume, but population-adjusted performance reveals Swiss dominance. For confirmed 2025 VC investment, we will have to wait for Startupticker.ch’s Swiss Venture Capital Report.

The European Spinouts Report 2025 provides crucial context. Switzerland ranks third in Europe for total spinout value, but when adjusted for population, ranks first with an index score of 100—the runner-up scores just 33.

ETH Zurich ranks third and EPFL fourth among all European universities for deep tech spinout value, behind Oxford and Cambridge. The University of Zurich secures ninth place, giving Switzerland three universities in Europe’s top ten. Together, Swiss institutions have generated over CHF 44 billion in spinout enterprise value. In 2025, three of six $1 billion+ exits in Europe came from Swiss universities.

The Swiss Deep Tech Report 2025 confirms sectoral focus: 60% of Swiss venture capital flows into deep tech, the highest share globally.

Sectoral Dominance: Where Switzerland Leads Europe

Switzerland’s leadership becomes most visible in robotics. The country attracted over $280 million in robotics funding in 2025, more than any other European nation.

ETH Zurich ranks first in Europe for robotics spinout value, producing 41 VC-backed robotics spinouts. EPFL ranks second with 22 VC-backed spinouts. Together, these institutions produced more robotics spinouts than the remaining eight European top ten universities combined.

ANYbotics, an ETH Zurich spinout, exemplifies this commercial translation. The company raised $20 million in September 2025, bringing total funding above $150 million as it scales autonomous industrial inspection robots.

Switzerland also demonstrates strength in digital capital (nearly $190 million), space tech (over $155 million), and biotechnology (over $150 million).

A Deep Tech Nation with Regional Strengths

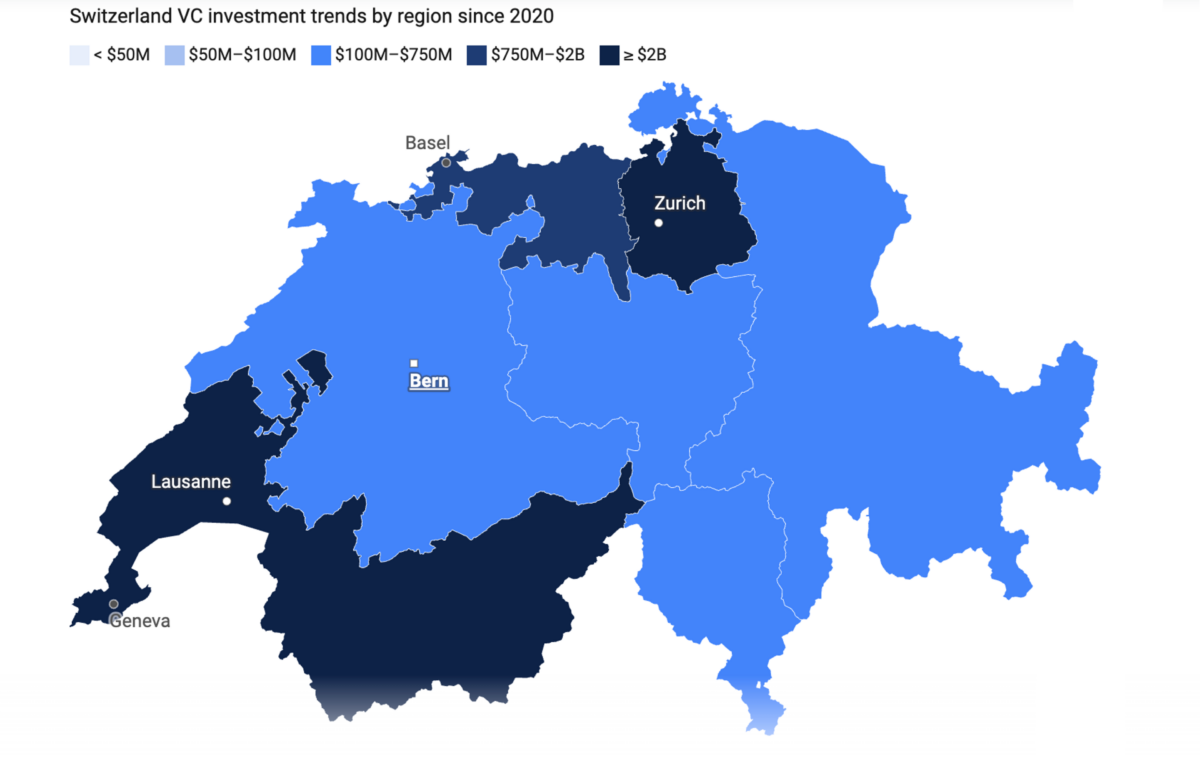

Three Swiss cities captured over $1.8 billion in combined VC funding in 2025 despite representing less than 2 million residents combined. Zurich, Lausanne, and Basel each translate academic strengths into commercial sectors where Switzerland leads Europe.

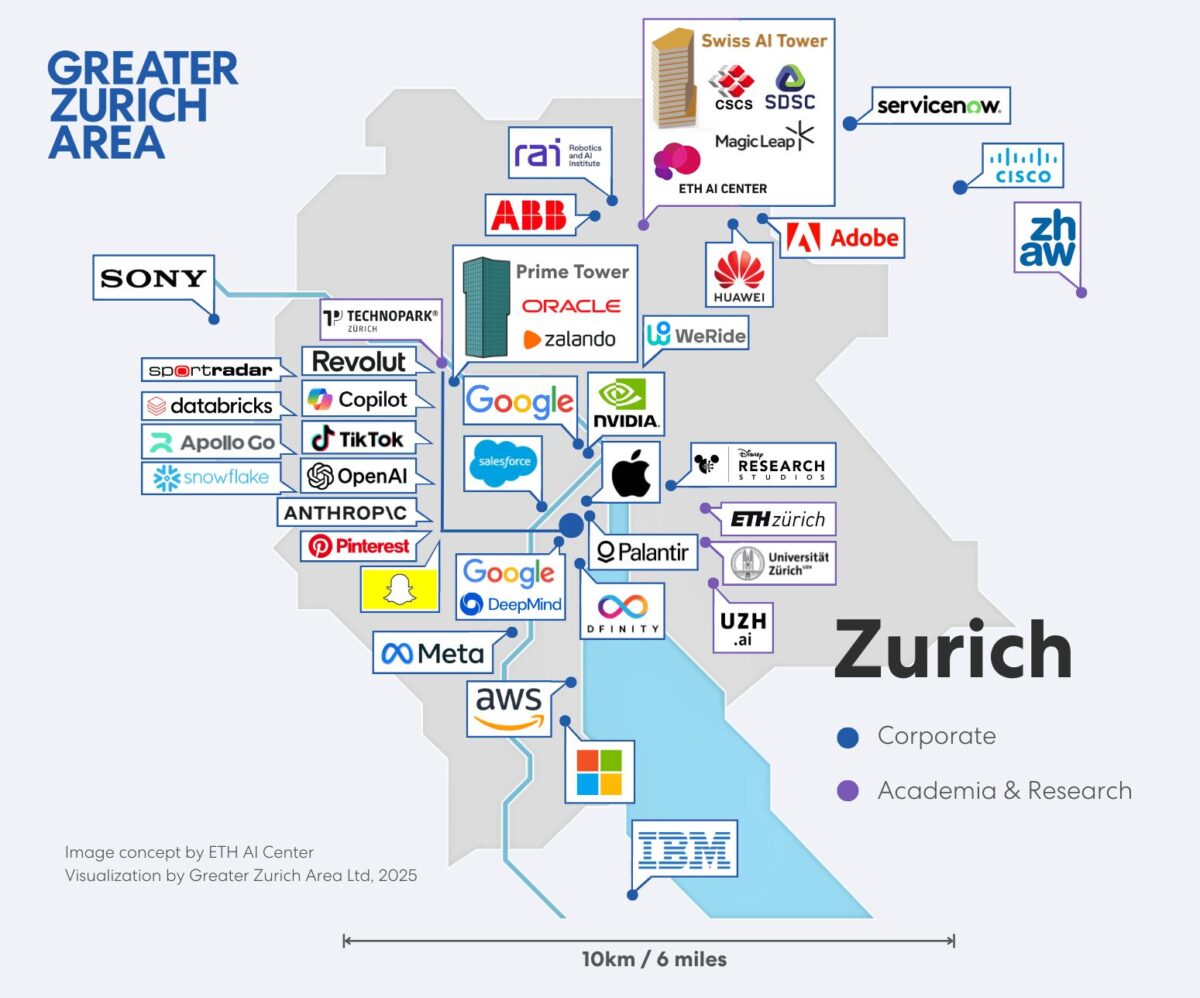

Zurich: Europe’s Most Concentrated AI Hub

Zurich anchors Switzerland’s deep tech ecosystem. The city holds the second-highest AI talent density in Europe, with Switzerland commanding nearly 5% of Europe’s core AI talent—the highest density continent-wide.

This concentration has attracted seven of the world’s top ten AI companies: Microsoft, Alphabet, NVIDIA, Meta, IBM, Adobe, and Palantir. Google operates its largest research hub outside the United States here, employing over 5,000 people. OpenAI, Anthropic, and Microsoft AI recently expanded to the region.

The Greater Zurich Area spans over 185 AI and robotics entities, achieving higher BigTech density than Silicon Valley in 34 square miles. ETH Zurich ranks among the world’s top ten universities in engineering and computer sciences.

Lausanne: Climate Tech and Life Sciences Innovation

EPFL’s research strengths in climate technology, semiconductors, and life sciences give Lausanne distinct positioning. The institution bridges fundamental research in sustainable energy with commercial applications in carbon capture, clean hydrogen, and next-generation batteries. Its medical device programs complement Basel’s pharmaceutical strength, creating a life sciences corridor across French-speaking Switzerland.

Proximity to international organizations including the IOC and UN agencies provides unique market access for sports technology and humanitarian innovation ventures.

Basel: Life Sciences Heritage Meets Digital Health

Home to Roche and Novartis headquarters, Basel possesses unmatched expertise in drug development and regulatory affairs. This pharmaceutical heritage now fuels a digital health and medtech cluster leveraging deep biological systems knowledge. Startups in precision medicine, diagnostics, and therapeutics benefit from immediate access to pharmaceutical expertise and corporate partners.

The concentration of life sciences talent—from medicinal chemists to regulatory specialists—creates conditions for rapid iteration between research and commercial validation.

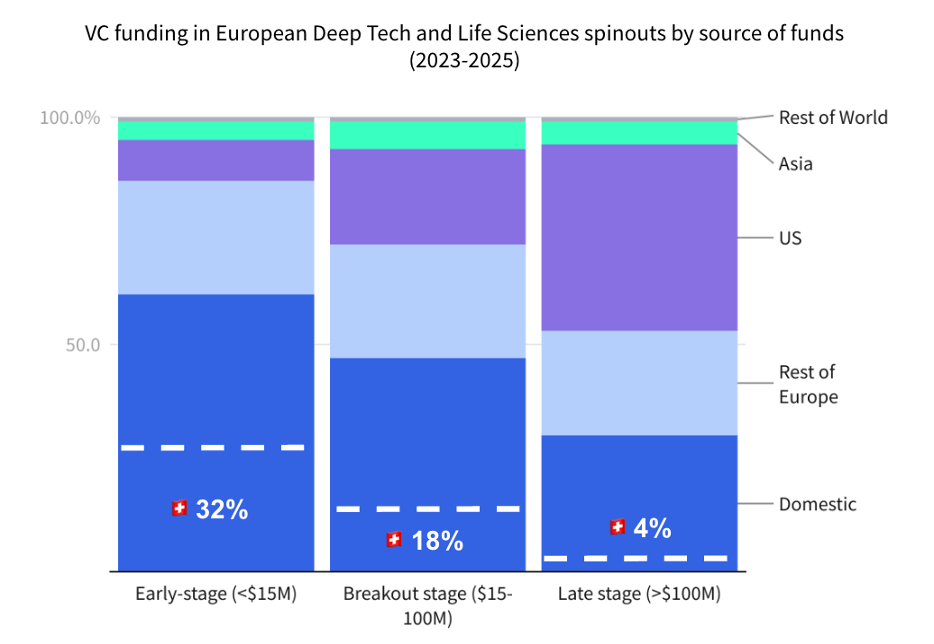

International Validation Through Capital Flows

Switzerland’s technical excellence attracts global capital. The Swiss Deep Tech Report 2025 shows that 85% of Swiss deep tech funding comes from international investors. The European Spinouts Report reveals that while 86% of early-stage capital originates in Europe, nearly half of late-stage funding flows from outside the continent, predominantly from the United States, demonstrating that international investors have a disproportionate appetite for Swiss startups.

Ninety-six percent of late-stage deep tech rounds were led by global investors between 2023 and 2025. The country’s over 640 VC-backed deep tech startups have raised nearly $7 billion since 2020, with combined enterprise value for the ecosystem reaching over $100 billion—more than triple the 2019 level.

Efficiency as Competitive Advantage

Switzerland’s fourth-place ranking in European VC funding masks its true position as the continent’s most efficient deep tech ecosystem. Per-capita metrics, university spinout performance, and sectoral concentration reveal a model prioritizing quality over volume. The convergence of ETH Zurich and EPFL research excellence, Europe’s highest AI talent density, and systematic support infrastructure creates conditions for converting scientific breakthroughs into commercial scale.

As European policymakers seek frameworks for global deep tech competition, Switzerland offers a template: concentrate resources on research excellence, cultivate sectoral depth, and create conditions attracting international capital. The Dealroom Q4 2025 data confirms Switzerland has achieved this model at scale.

Switzerland’s efficiency model now extends to scaling, which remains a challenge in a country that innovates like none-other but struggles to provide the resources to scale. Project Switzerland addresses the ecosystem’s primary gap: converting early-stage excellence into category-leading global companies. The initiative connects high-potential scaleups with international capital, executive talent, and market access during the critical Series B to pre-IPO phase. The objective is to multiply Switzerland’s 39 unicorns into dozens of category definers across robotics, AI, climate tech, and life sciences.

FAQ on Switzerland’s Dealroom Q4 2025 Rankings

Why does Switzerland rank 4th in Europe for VC funding despite its innovation leadership?

Switzerland’s fourth-place ranking reflects absolute investment volume rather than innovation output or efficiency. With a population of 8.7 million, Switzerland competes against countries with significantly larger populations and economies. The more revealing metric is per-capita performance, where Switzerland ranks first in Europe for deep tech spinout value with an index score three times higher than the runner-up.

How does Switzerland compare to other European countries on a per-capita basis?

Switzerland dominates per-capita metrics across multiple dimensions. The country holds the highest density of core AI talent in Europe and ranks first for spinout value per capita. Switzerland allocates 60% of venture capital to deep tech, the highest share globally. When adjusted for population, these metrics reveal Switzerland creates more deep tech value per citizen than any other European nation.

Which sectors drive Switzerland’s deep tech leadership?

Robotics represents Switzerland’s clearest sectoral dominance. The country attracted over $280 million in robotics funding in 2025, more than any other European nation. ETH Zurich ranks first in Europe and EPFL second for robotics spinout value. Switzerland also demonstrates strength in AI, with Zurich holding the highest AI talent density in Europe, along with biotechnology, climate tech, and space technology.

What role do ETH Zurich and EPFL play in Switzerland’s ecosystem?

ETH Zurich and EPFL function as primary innovation engines. ETH Zurich ranks third and EPFL fourth among all European universities for deep tech spinout value creation. Combined, Swiss universities have generated over CHF 44 billion in spinout enterprise value. ETH Zurich has produced 41 VC-backed robotics spinouts and ranks among the top ten universities worldwide in engineering and computer sciences. These institutions bridge fundamental research and commercial application more effectively than most European peers.

What explains Switzerland’s high international investor participation?

Switzerland attracts international capital through demonstrated technical excellence and strong exit performance. The Swiss Deep Tech Report 2025 shows 85% of Swiss deep tech funding comes from international investors. In 2025, three of the six $1 billion+ exits in Europe originated from Swiss universities. This track record, combined with Switzerland’s political stability, IP protection framework, and concentrated technical talent, makes the country attractive for growth-stage capital deployment.

How does Zurich’s AI ecosystem compare to other European tech hubs?

Zurich has established itself as Europe’s most concentrated AI hub. The city holds the highest AI talent density in Europe. The Greater Zurich Area hosts over 185 AI and robotics entities and achieves higher BigTech density than Silicon Valley in just 34 square miles. Seven of the world’s top ten AI companies operate in Greater Zurich, including Google’s largest research hub outside the United States.

More Content

-

On January 29, 2025, SIX Swiss Exchange and Swisscom Ventures convened Switzerland’s tech community for a frank discussion about IPOs. With BioVersys reflecting on its…

-

The Relay Node Olivier Laplace, Partner at Vi Partners, still views the world through the structural lens of a software engineer. While his days of…

-

From Relaying to Refunding If Part 1 was about the who – Olivier Laplace as the “relay node” in a vast network -Part 2 is…