/

The Evidence We Needed: Establishing the First Benchmark for Swiss VC Return

For years, institutional investors have cited the same obstacle when asked about venture capital allocation: insufficient performance data. Without a credible benchmark, Swiss pension funds holding CHF 1.2 trillion in assets have kept VC allocations near zero, while their American counterparts invest roughly 2% in the asset class (according to OECD Global Pension Statistics). To break this impasse, University of Basel, SECA, and Deep Tech Nation Switzerland Foundation have released the first comprehensive study on Swiss venture capital fund returns. The findings provide concrete answers to questions that have long shaped the investment debate.

The Findings in a Nutshell

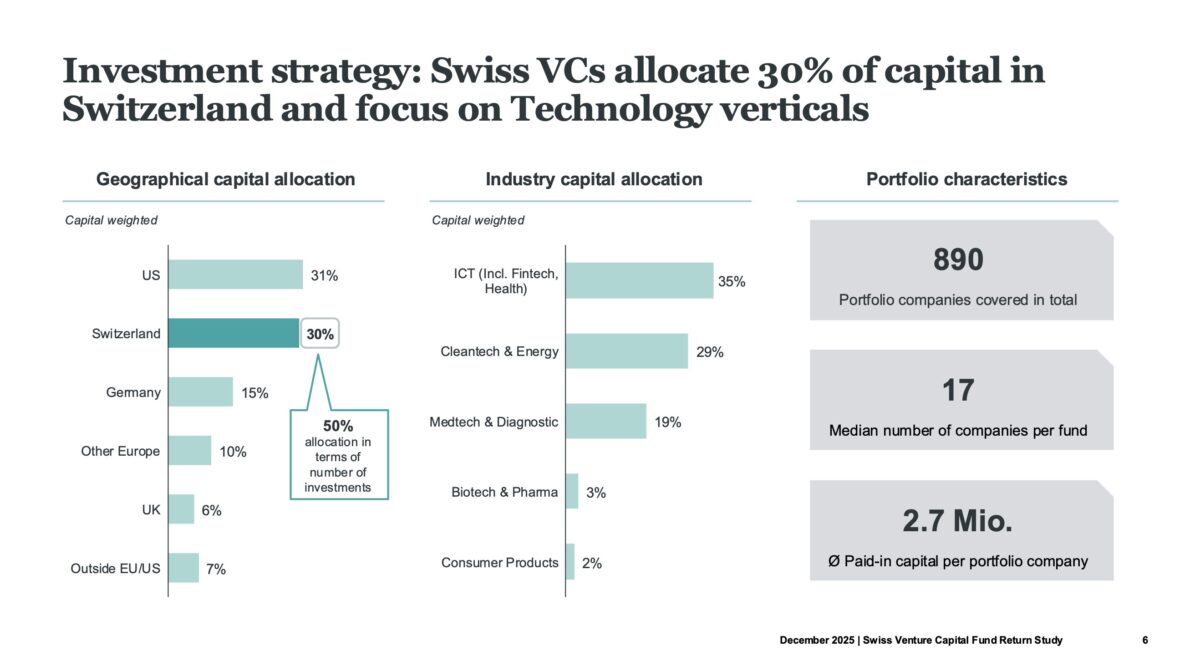

| Investment strategy | Swiss VCs allocate 30% of capital (50% by numbers of investments) in Switzerland and focus primarily on Technology |

| Market returns | Swiss VCs are at par with European VCs with outperformance in younger vintages |

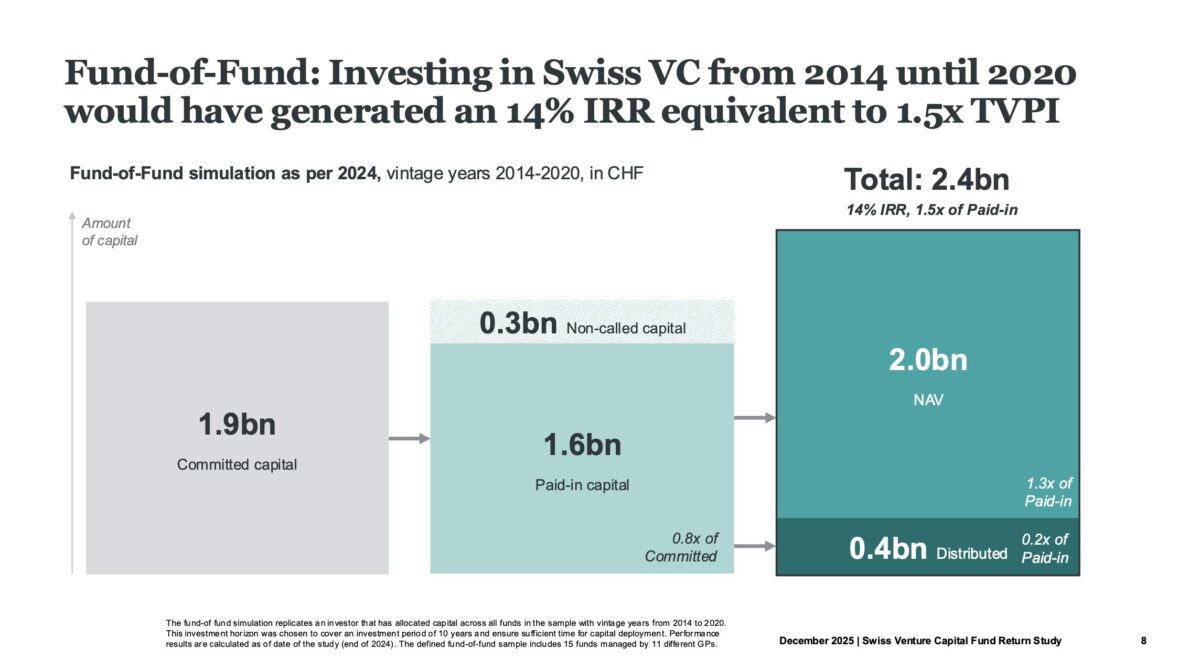

| Fund-of-Fund | Investing in Swiss VC from 2014 -2020 until end of 2024 would have generated an IRR of 14% |

A New Benchmark for Switzerland

The study analyzed cash-flow data from 18 leading Swiss VC firms managing more than 40 funds with over CHF 3.5 billion in committed capital. Vintage years span from 2000 to 2024. This represents actual fund-level performance reported directly by Swiss fund managers, and not modeled data or estimates derived from comparable markets.

For the first time, Switzerland has a locally-sourced, independently verified VC benchmark that can be tracked and updated annually.

Performance: Competitive with Europe, Stronger in Recent Years

The central question for any institutional investor is straightforward: does the asset class deliver returns?

Swiss VC funds perform on par with the European Venture Capital Benchmark maintained by the European Investment Fund and BlackRock (as of 31 March 2025). Historical data shows consistent alignment with continental peers. More notably, Swiss funds with vintage years between 2020 and 2024 are outperforming the European benchmark on both Internal Rate of Return (IRR) and Total Value to Paid-in Capital (TVPI) measures.

To quantify what a diversified allocation would have produced, the study simulated a fund-of-fund investment across all participating funds from 2014 -2020 vintages (until end of 2024). The results:

- 14% Internal Rate of Return (IRR)

- 1.5x Total Value to Paid-in Capital (TVPI)

- 84% of committed capital called

- 22% of paid-in capital distributed back to investors

For pension fund allocation committees seeking hard evidence before committing to the asset class, that study provides what has been missing from the Swiss market: verifiable, locally-sourced return data.

With reliable performance data, Swiss venture capital can finally be seen for what it is: a high-performing asset class that strengthens our economy.

Dario My, Head of Venture Hub Deep Tech Nation Switzerland

Where the Capital Actually Goes

A persistent assumption in Switzerland holds that domestic VCs raise capital locally but deploy it primarily abroad. The data tells a different story.

On average, Swiss VC funds allocate 30% of their capital to Swiss startups. When measured by number of deals rather than capital volume, the domestic allocation rises to 50%. This is substantially higher than previous estimates suggested and significantly above what existing return databases reflect for Switzerland.

The sectoral focus is equally clear. Technology, including ICT, fintech, and healthtech, accounts for 35% of deployed capital. Cleantech and energy follow at 29%, with medtech and diagnostics at 19%. The median fund manages portfolios of around 17 companies, with an average investment of CHF 2.7 million per company.

For Swiss founders, these figures confirm that strengthening local VC capacity translates directly to capital available for domestic innovation.

From Anecdote to Annual Benchmark

Beginning this year, the study will be conducted annually. This shifts the conversation from anecdotal impressions to systematic measurement. As the dataset grows and additional fund managers participate, the benchmark will offer increasingly granular insights into how Swiss VC performance evolves over time.

The implications extend beyond reporting. With credible performance data now available, the argument for institutional allocation rests on evidence rather than assumption. The returns are documented, the local impact is quantified, and the methodology is transparent and repeatable.

Deep Tech NationSwitzerland has set a target of reaching CHF 5 billion in annual VC investment in Switzerland. Achieving that figure requires pension funds to participate at meaningful scale. They now have the data to evaluate the opportunity on its merits. The question is no longer whether Swiss VC can perform; it demonstrably does. The question is whether Switzerland will mobilize its institutional capital accordingly.

With more transparency on Swiss VC fund return data, we are closing an ever open gap. Together with the figures reported in the Swiss VC report on fundraising, investments and exits (since 2012) we can now rely on a comprehensive Swiss VC investment cycle data base.

Thomas Heimann, Chair VC Chapter, Deputy General Secretary SECA

Download the report – English

Download the report – German

About University of Basel

The University of Basel is the oldest university in Switzerland. Among other areas, it conducts research in the field of Venture Capital, with a particular focus on investment structures and asset class returns. By collecting key data on VC investments, the goal is to better understand the overall asset class performance and to further support and professionalize Venture Capital investments and their framework conditions in Switzerland.

About SECA

The Swiss Private Equity & Corporate Finance Association (SECA) represents the Swiss private equity, venture capital and corporate finance sectors. The aim of the SECA is to represent private equity and corporate finance activities to the relevant target groups and the public. It also promotes the exchange of ideas and co-operation between members and their clients. The promotion of professional development and the development and implementation of ethical rules of conduct are further areas of responsibility.

About Deep Tech Nation Switzerland Foundation

Deep Tech Nation Switzerland Foundation is a private, not-for-profit initiative backed by leading companies, foundations, associations, and universities. We act as a driving force to position Switzerland as the world’s leading Deep Tech Nation. Our focus is on empowering startups and scale-ups to become global players in their market, doubling the venture capital investments to 5 billion annually and creating 100’000 jobs by 2033. We work autonomously and systemically to strengthen the Swiss innovation ecosystem for the long term. Acting as a neutral catalyst, we shape the future for Switzerland, so that others can create, scale, and invest.

More Content

-

Today marks a defining moment for the Swiss innovation ecosystem. Deep Tech Nation Switzerland officially launching Project Switzerland, a national initiative with a singular, critical…

-

More money has flowed into all Swiss scale-ups per capita than into scale-ups in the US or Israel. This is backed by a ten-year growth…

-

Impatience is Imperative There is a distinct cultural friction when a Swiss founder steps into the US market. In Switzerland, the prevailing operating system is…